![]()

If you a motor vehicle (car, truck, etc.) hits you while you’re on a bicycle in Florida, Personal Injury Protection (PIP) insurance may pay for some of your medical bills.

The most that PIP will pay for your medical bills is $10,000. This article does not address getting your lost wages paid or getting money for pain and suffering.

Florida Statute §627.736 gives benefits to people “while not an occupant of a self-propelled vehicle.” Most insurance policies use the word “pedestrian” to refer to someone who is “not an occupant of a self-propelled vehicle.”

Bike riders are “pedestrians” under the PIP law. Therefore, if you are riding a bicycle you qualify for PIP.

Bike Rider Gets PIP From His/Her Own Car Insurance

If a motor vehicle hits a bike rider in Florida, the bicyclist’s first place to look to get his medical bills is through his own PIP coverage.

As an example, assume Mike is riding a bike in Miami, Florida. A car cuts Mike off. Mike crashes into the car.

State Farm insures a car that Mike owned in Florida at the time of the accident. Mike should make a PIP claim through his own Florida car insurance.

State Farm will pay 80% of Mike’s medical bills up to $10,000. State Farm would do this even if Mike was wholly, or partly, at fault for the crash.

I had a case like this, except USAA was Mike’s* insurance company. USAA paid $10,000 towards Mike’s medical bills. Florida lawyers do not charge a fee on the PIP benefits recovered, unless they have to sue to get them.

We also made an injury claim against the car driver’s and/or owner’s insurance, United Auto Insurance Company, as well as Mike’s uninsured motorist (UM) insurance, USAA.

This claim was for out of pocket medical bills, future medical bills, lost wages, past pain and suffering, and future pain and suffering.

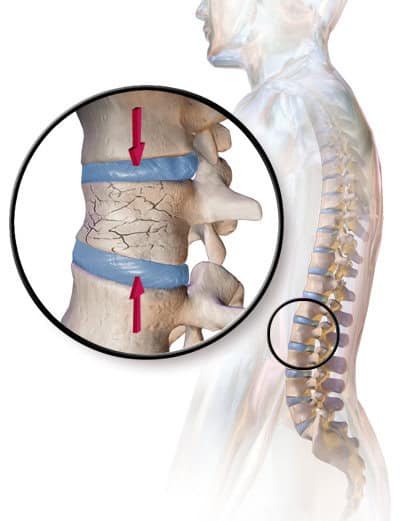

Mike (not real name) had a compression fracture of his thoracic vertebrae (mid-back). Below is an illustration of a compression fracture.

The total settlement was for $52,500.

Bike Rider Gets PIP From His/Her Own Car Insurance (If Hit By an Uber With App on, But Not Engaged in a Ride)

What happens if an Uber driver hits a bike rider, and the driver’s app was on but he/she wasn’t engaged in a ride?

In this instance, the bicyclist would use PIP coverage from his or her own car insurance. The same is true if it were a Lyft driver who hit the bike rider.

The bike rider can also make a personal injury claim against the Uber driver. The Uber driver will have $50,000 per person bodily injury liability limits.

![]()

The same limits would apply if a Lyft driver hits a bike rider, and the app was on but he wasn’t engaged in a ride.

Bicyclist May Need an Accident Reconstruction Expert (To Get a Settlement)

In the bikes rider’s personal injury claim against the at fault driver, he may need to hire accident reconstructionist. This will ensure that the at fault driver may be liable for 100% of the bicyclist’s medial bills. I’m referring to medical bills that PIP doesn’t cover.

The accident reconstructionist should have experience in personal injury cases where a car hits a bicyclist.

Accident reconstruction experts aren’t cheap. The injured person (or his attorney) can easily wind up spending thousands of dollars on his or her expert.

However, an accident reconstruction expert can make or break the case.

Insurance companies like Windhaven, Nationwide, Chubb and others are willing to spend thousands on expert witnesses. Are you?

There are many 12 benefits of hiring a injury lawyer for a bike accident case. One benefit is that the accident attorney can pay the accident reconstructionist up front.

If the attorney is able to reach a settlement, the attorney gets paid back for this cost. If the attorney can’t recover compensation, you don’t owe the attorney any money. Basically, there are no fees or costs if no recovery.

Which bike accident reconstruction experts are the best for an injury case?

Many personal injury attorneys believe that James Green is the best bicycle accident reconstruction expert. Green is located in in Ashville, North Carolina. For a bike accident case with a permanent injury, he is likely worth the cost.

Thus, if a bike accident has resulted in a surgery, Green’s added value to the case may be worth the cost.

Another choice is Timothy Joganich, MSES, C.H.F.P. He is located in Pennsylvania. However, he can still testify in Florida. I’ve heard that Timothy is a solid expert for a personal injury case where a car hits a bicyclist.

What does Joganich’s testimony looks like? Here is an appeal where Joganich testified as bicycle accident reconstructionist. That wasn’t my case. In fact, it isn’t a Florida personal injury case.

The case is from another state. However, you can see what a bicycle accident reconstructionist’s testimony.

Resident Relative’s PIP May Pay Bike Rider’s Medical Bills

Take the facts of Mike’s case above. Except assume that Mike:

- Didn’t own a motor vehicle in Florida at the time of the accident.

- Lived with a relative, who owned a motor vehicle in Florida that was insured.

In this example, the resident relative’s PIP insurance would pay up to $10,000 of Mike’s medical bills.

I handled a case that was similar to this example. My client was staying with her daughter when the accident happened. My client didn’t own a car. GEICO insured the daughter’s cars.

GEICO paid the hospital $10,000 from the PIP coverage for my client’s medical expenses. I also made a claim against the at fault pickup truck driver’s bodily injury (“BI”) liability auto insurance, USAA.

USAA settled the case with us for $100,000.

In this example, if an Uber driver hit Mike, then Mike’s relative’s PIP insurance would pay Mike PIP Benefits. Uber wouldn’t be responsible for Mike’s PIP benefits. The same is true if Mike crashed with a Lyft car.

If a Car Hits a Bicyclist, and the Bicyclist Lives With Relative Who Owns an Uninsured Car, Will the At Fault Car’s PIP Pay the Bike Rider’s Bills?

Yes, assuming that the bicyclist did not own a car in Florida. State Farm Mut. Auto. Ins. Co. v. Pierce, 383 So. 2d 1184 – Fla: Dist. Court of Appeals, 5th Dist. 1980.

The insurer must pay the bills according to PIP law. However, if the bike rider was visiting from another state, then the at fault car’s PIP won’t cover the bicyclist.

Motor Vehicle Owner’s PIP Insurance May Pay Bike Rider’s Medical Bills

If a bicyclist lives in Florida, doesn’t own a car, and doesn’t live with a resident relative who has auto insurance, then the bike rider can make a claim with the at fault vehicle’s PIP.

Let’s take an example. Assume Mike is riding a bike in Miami, Florida. A car cuts Mike off. Mike crashes into the car.

He doesn’t own a car in Florida. Mike doesn’t live with any resident relatives who own a motor vehicle.

Assume that Progressive insures the at fault car. Progressive will pay 80% of Mike’s medical bills up to $10,000.

Progressive would pay the 80% even if Mike was wholly, or partly, at fault for the crash. Mike can also make a personal injury claim against the careless driver’s BI liability coverage.

This claim is for out of pocket medical bills, future medical bills, lost wages, past pain and suffering, and future pain and suffering.

Uber PIP Insurance May Pay Bike Rider’s Medical Bills if App on But Not Engaged in a Ride

Let’s take the above example where a bike rider doesn’t own a car. He doesn’t live with a relative who owns a car.

In this scenario, if an Uber driver hits the bike rider, and the Uber driver had the app on but wasn’t “engaged in a ride”, the Uber has PIP. Florida Statutes 627.748(b)(1)b. Thus, the bicyclist can make a PIP claim with Uber’s insurance. The same is true if it a Lyft driver crashed into a bicyclist.

The James River Insurance Company insures Uber cars. Zurich American Insurance Company insures Lyft cars. York Risk Services Group handles Lyft claims.

Uber’s PIP Insurance Won’t Pay Bike Rider’s Medical Bills if Uber is Engaged in a Ride

If an Uber driver hits a bike rider, and the Uber driver was “engaged in a ride”, the Uber doesn’t have to have PIP. Florida Statutes 627.748(c)(1)b. Moreover, Uber’s insurance policy doesn’t have PIP in this instance.

Thus, the bicyclist can’t make a claim with Uber’s PIP insurance. He can still make a claim against the Uber driver’s BIL insurance. I’ll discuss this more in detail later.

Lyft’s PIP Insurance Will Pay Bike Rider’s Medical Bills if Lyft is Engaged in a Ride

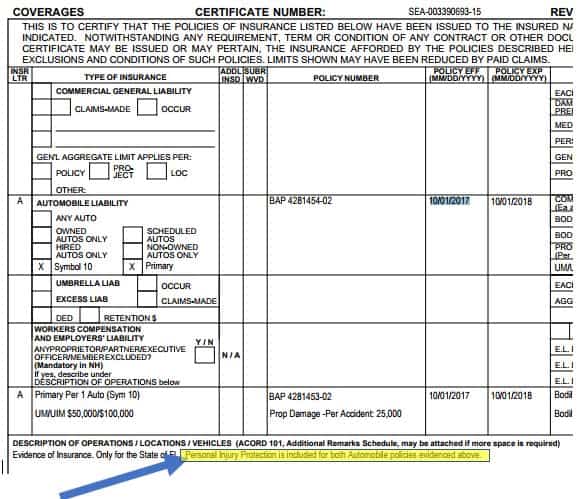

If a Lyft car hits a bike rider, and the Lyft car was “engaged in a ride”, the Lyft doesn’t legally have to carry PIP. Florida Statutes 627.748(c)(1)b. However, Lyft’s insurance policy has PIP in this instance. Below is an image that shows this.

Thus, the bicyclist can’t make a claim with Lyft’s PIP insurance. He can also make a claim against Lyft’s BIL coverage for the 20% of medical bills that PIP doesn’t cover.

The bike rider can also sue for pain and suffering and other damages. I’ll discuss this more in detail later.

Nonresident Bike Rider Can’t Get PIP From At-fault Motor Vehicle

Take the facts of the above two examples except assume that the bicyclist doesn’t live in Florida. The at fault car owner’s PIP will not pay for the bike rider’s medical bills.

However, a nonresident’s Medpay coverage in his auto insurance policy may cover his medical bills. I’ve represented at least one individual from another state who Medpay coverage paid for medical bills while he was hit as a pedestrian in Florida.

As a reminder, a bicyclist is considered a pedestrian for purposes of PIP.

Does a Bike Rider Get PIP if Car From Another State Hits the Bicyclist in Florida?

If you are riding a bicycle in Florida, and you are hit by a motor vehicle that is registered in another state, you are entitled to have PIP pay your medical bills. Cavalier Ins. Corp. v. Myles, 347 So.2d 1060 (Fla. 1st DCA 1977).

If you own a motor vehicle in Florida, then your PIP insurance pays for your medical bills up to $10,000.

Who Pays if You Don’t Own a Motor Vehicle in Florida?

If you don’t own a motor vehicle in Florida, then your resident relative’s PIP will pay for up to $10,000 of your medical bills.

Who Pays if You Don’t Own a Motor Vehicle, or Live With a Relative, in Florida?

If you don’t own a motor vehicle in Florida, and you don’t live with a resident relative who owns a motor vehicle in Florida, then the at fault car owner’s PIP insurance may pay for your medical bills.

Whether the at fault motor vehicle owner’s PIP pays will depend on whether his or her auto insurance policy “takes on” Florida’s minimum PIP requirements when the vehicle is driven in Florida.

If the motor vehicle owner’s insurance policy “rolls over” to Florida, then his or her PIP will cover your medical bills.

If it doesn’t roll over, you won’t get PIP to pay your medical expenses. However, if you can show that the driver was negligent, he or she has to pay for your medical bills.

Does a bike rider need a permanent injury for the at fault driver’s BI insurance to pay future medical bills?

No. You just need to show that the at fault driver’s negligence caused your future medical expenses.

Losing control of bike and crashing while trying to avoid a crash with a truck in Florida

Just because you are injured while on your bicycle and a motor vehicle is involved is not enough to get you PIP benefits. One Florida case states that a bicycle rider that could not control his bike and crashed while trying to avoid an accident with a truck was not entitled to PIP benefits because the bike did not make “contact” with the truck. Smith v. Fortune Insurance Co., 506 So.2d 73 (Fla. 5th DCA 1987).

Do bikes with a motor qualify for PIP in Florida?

Even if you have installed a motor on your bicycle, you would still qualify for PIP benefits. This is because a Florida Court has said that a bicycle with a motor is similar to a bicycle in “design, appearance and capacity.” Allstate Ins. Co. v. Dixon, 508 So.2d 542 (Fla. 3d DCA 1987).

So, if a car hits you while you are riding a bicycle that has a motor installed on it, you can get your medical bills paid through PIP insurance.

Pedestrian jumping out of way to avoid car crash gets PIP in Florida

But the Florida 4th District Court of Appeal stated that a pedestrian that was hurt was jumping out of the way of a vehicle – that was driving carelessly – was entitled to PIP even though there was not contact between the pedestrian and the vehicle. Amica Mutual Insurance Co. v. Cherwin, 673 So.2d 112 (Fla. 4th DCA 1996).

A bicycle rider can argue that the physical contact requirement should be looked at with a very relaxed standard under Florida Statute 627.736(1). This would allow the bicyclist to get PIP benefits.

Example

You are riding a bicycle in Miami or any city in Florida. A car swerves close to you, and you quickly make a turn to avoid the car. Part of your bike hits the car.

You fall off the bike and fracture your elbow. Because you came into contact with the car, you are entitled to PIP.

If you are riding a bicycle and you are hit by a motor vehicle (truck, car, etc.), you are entitled to PIP coverage under:

- Your car insurance policy

- The car insurance policy of a relative that you live with

- The insurance policy of the motor vehicle that struck you

You may also be entitled to med pay benefits in addition to PIP.

When Aren’t You Entitled to Med Pay Insurance Benefits

You are not entitled to med pay benefits – to cover the PIP coinsurance – from the motor vehicle (car, truck, etc.) that struck you if you are not considered an insured under the vehicle’s insurance policy. Allstate Ins. Co. v. Jones, 700 So.2d 110 (Fla. 1st DCA 1997).

This is because Section 627.736(4)(f), Florida Statutes, requires med pay to cover PIP coinsurance only if med pay “is available.”

If the motor vehicle’s – that strikes you – policy allows for med pay only to insureds, and you are a bicyclist that is covered under your or a resident relative’s PIP, you are not insured for other policy provisions which in this case is med pay benefits.

Example – When You May Be Get PIP But Not Med Pay Benefits

You are riding a bicycle in Coral Gables or any city in Florida. A car (or any motor vehicle) crashes into you because you’re not paying attention.

You own a car in Florida that is insured. Because PIP pays benefits regardless of fault, PIP will pay at most 80% of your medical bills up to $10,000 subject to exceptions.

Let’s assume that you did purchase med pay benefits – to cover the PIP coinsurance.

If the car has med pay under its policy, you will not get med pay benefits if the car – that you struck – has an insurance policy that only allows med pay to insureds.

Because you are getting PIP through your own car insurance, you are not considered an insured of the car that you hit.

Your Health Insurance May Pay Your Bills

If you are in a bicycle accident, your health insurance may pay for some of your medical bills. You should give all of your doctors your health insurance information, even if you are entitled to PIP.

If your health insurance paid some of your medical bills, they may have a lien (right to recover) the money that they paid if you settle your bike accident case. Be careful when attempting to negotiate down your lien.

Certain “health insurers” are required to reduce their lien by your injury attorney’s fees and costs. This is true if you have non-group health insurance, if you work for a small employer, or if you work for a county or city employer.

Likewise, Medicare will reduce its lien by your accident attorney’s fees and costs. If many circumstances, Medicaid is required to reduce its lien by your attorney’s fees and costs.

At Fault Driver’s Bodily Injury Liability Insurance May Pay Compensation

In order to try to get your medical bills paid by the driver – or owner – of the car that hit you, you would have to show that the driver was at fault.

If the driver was at fault, you need to hope that either:

- The driver and/or owner – or his or her employer – has BI BI liability insurance.

If there is no bodily injury liability available, you have one last resort, which is uninsured motorist insurance.

How Does Uninsured Motorist Coverage (UM) Work if a Driver Hits a Bike Rider?

Unfortunately, many drivers don’t carry bodily injury liability (BIL) insurance. If the driver who hit you wasn’t working at the time of the crash, you can’t sue his or her employer.

However, if you’re entitled to uninsured/underinsured (UM/UIM) motorist insurance benefits, you can make a claim against the UM coverage.

Earlier, I talked about my $52,500 settlement after a car hit a bike rider. The UM insurance paid $42,500 of that settlement. Without undersinsured motorist insurance, the bike rider would’ve missed out on an additional $42,500 in compensation. He would’ve been stuck with the careless driver’s $10,000 BIL insurance policy.

Can a Bike Rider Make a UM Claim if He/She Lives With a Relative Who Does?

Maybe, if the bicyclist lived with a relative who owns a car that has UM. In that case, the bike rider can make a claim through the relative’s UM insurance. This is because they’re related by blood and the bike rider lives with him or her.

If you are not related “by blood, marriage or adoption,” then you don’t qualify for your resident relative’s UM insurance. This is true even if you had lived with and been dependent upon the named insured for many years, similar to a relative. Allstate Ins. Co. v. Hilsenrad, 462 So.2d 1202 (Fla. 3d DCA 1985).

Who Pays a Bike Rider’s Medical Bills if He or She is Hit and Later Dies?

If a bicyclist is hit and killed by a motor vehicle in Florida, the bicyclist may be covered by PIP. If he or she is covered, then PIP will pay:

- up to $10,000 of the bike rider’s bills; and

- a $5,000 death benefit

Should You Hire an Attorney if You’re Hurt in a Bike Accident?

![]()

If you’re asking this question, the answer is likely “Yes”. A bike accident lawyer will know who should be paying your medical bills. The attorney will also know if the careless party should be paying 100% of your medical bills.

He or she will know if you have a claim for lost wages, pain and suffering, emotional distress, loss of enjoyment of life and more.

Additionally, a bike accident attorney will have a good understanding of how much your case is worth. This will reduce your anxiety and stress. You won’t guessing about your claim’s value.

An attorney can send a request to the careless driver’s insurer, which asks for the liability insurance limits. There are 12 reasons to hire a good accident lawyer.

Be sure to ask any attorney about their past bike accident settlements. Ask the lawyer if they’ve dealt with the insurance company who is involved in your claim. Hopefully, at a minimum, they’ve settled many cases with GEICO, Progressive, State Farm, Allstate, USAA, Travelers, United Auto and Infinity Insurance.

Not a day goes by where I don’t learn something new about injury cases. And I’ve been representing injured people for 14 years. That shows you how much there is to know in order to maximize the value of a bike accident case.

Did someone cause your injury in a Florida car crash or other type of accident?

See Our Settlements

Check out some of the many Florida injury cases that we have settled, including but not limited to car accidents, truck accidents, motorcycle accidents, bike accidents, pedestrian accidents, taxi accidents, drunk driving (DUI) accidents and much more.

We want to represent you!

Our Miami law firm represents people injured anywhere in Florida in car accidents, truck accidents, slip, trip and falls, motorcycle accidents, bike accidents, drunk driving crashes, pedestrian accidents, taxi accidents, accidents involving an Uber or Lyft Driver, and many other types of accidents.

Call Us Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.

Leave a Reply