A Florida store, shopping mall, hotel or other business establishment’s carelessness may cause your injury. If so, you may get medical treatment. There will be medical bills.

How to get your medical bills paid? This article focuses on just 1 of the 5 ways to help your slip and fall case. This short video discusses what to do if you slip and fall at a business or store.

You should give your health insurance or Medicaid, Medicare, etc. to the hospital billing department.

Medical Payments (Med-Pay) coverage

If you don’t have “health insurance” that will cover your bills, it is possible that the store or place that you tripped at has “medical payments” (Medpay) coverage in their insurance policy – if they have commercial general liability (CGL) insurance. Medical payments coverage pays for your medical bills if you are injured at a business (e.g., a store, hotel, or supermarket) regardless of fault.

For example, you could make a hotel injury claim in Florida and get Medpay coverage. For Medpay to apply, you need to show that the accident or incident happened at the business and your injuries were caused by the accident or incident. You do not have to prove that the business was at fault for the medical payments insurance to apply.

In some Florida Publix supermarket injury claims that I have handled, they did not have Medpay. From my experience, hotels and restaurants are more likely to have “medical payments” coverage under their insurance policy than big box stores and supermarkets (CVS, Publix, etc.).

Every insurance company that I have dealt with that has medical payments coverage – under their insured’s commercial general liability insurance policy (CGL) – will not pre-authorize medical treatment.

The insurer will pay the bills after the injured person has treated and submits the bill to the insurance company, or the insurer receives a bill from the medical provider (e.g. doctor or hospital).

If the business that you were injured at does not have an insurance policy that has medical payments coverage, then you have to prove that the business (e.g. store, mall, etc.) caused your accident in order to get any outstanding (unpaid) medical bills paid.

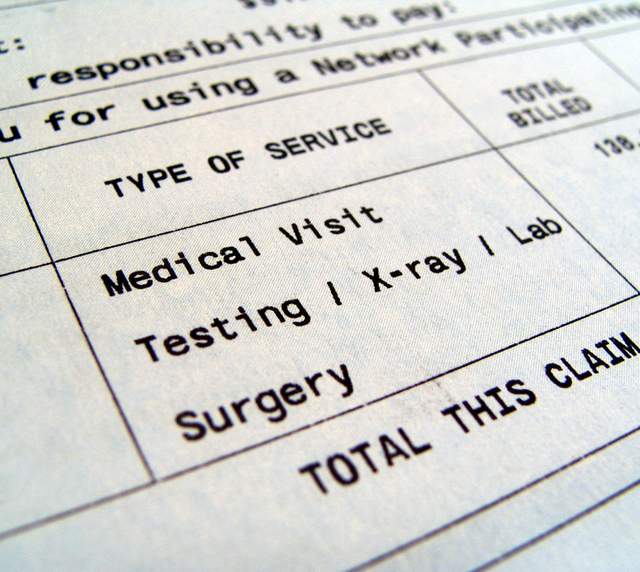

Even if the business has medical payments coverage, you still have a claim for past medical bills, if any, as well as future medical bills and other damages (lost wages, pain and suffering, etc.) that are you are able to get in a personal injury claim. There are 2 important things to do when your medical bills arrive:

1. Check for Insurance.

The first thing to do is to look at the hospital bill (or doctor bill) and see whether the bill shows your insurance information. This is of course if you have any insurance that may apply. If all of your insurances (such as if you Medicaid and Medicare) are not on the bill, you should immediately contact the medical provider and give them all of your insurance information that may cover you for this accident.

You should give this information to them over the phone and in at least 1 written form (fax, email, certified mail, regular mail).

This can possibly help your case get “completely finished” because you will know the amount, if any, that you are required to reimburse (pay back) the health insurance (or Medicare, Medicaid, etc.) company if the accident was caused by another.

This will give you a better idea of the amount of money that you will get after you pay back – if necessary – your health insurance company. You should use caution when paying back a health insurance company (or Medicare, Medicaid, Tricare, etc.) from your personal injury settlement.

2. Give Your Bills and Records to the Liability Insurer

If you were injured at a store, supermarket or any other business, you should let the business know that you have had an accident. You should do this in person and in writing. The sooner that you notify that business and get a claim number assigned, the sooner the company or their CGL insurer will assign an adjuster to the file.

The quicker that an adjuster is assigned to the file, the quicker that the adjuster can begin determining whether they believe that there insured – or client – was at fault.

You should send your medical bills and records to your CGL insurer so that they can begin paying your bills. If CGL insurance company denies liability, you may still have a great case. You may still be able to settle a case after the insurance company – or the claims adjuster for the business – denies your claim.

If you were injured in an accident caused by a company, hopefully the insurance company for the business does the right thing and pays your claim (medical bills, etc.). If not, you may have to file a lawsuit against the proper people or company.

Did someone’s carelessness cause you to slip or trip and fall and suffer an injury in Florida, or on a cruise or boat? Were you injured in another type of accident?

See Our Settlements

Check out some of the many Florida injury cases that we have settled, including but not limited to slip or trip and falls, supermarket or store accidents, cruise ship accidents and much more.

We want to represent you!

Our Miami law firm represents people injured anywhere in Florida in slip, trip and falls, store or supermarket accidents, cruise ship or boat accidents, accidents at someone else’s home, condo or apartment, and many other types of accidents.

We want to represent you if you were injured in an accident in Florida, on a cruise ship or boat. If you live in Florida but were injured in another state we may also be able to represent you.

Call Us Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.