If an Uber driver can’t work because of an accident, who pays him or her?

The answer depends on the state in which the accident happened. It may also depend on whether the Uber driver was engaged in a ride at the time of the crash.

Let’s start by looking at Uber accidents in Florida.

Uber Driver Not Engaged in Ride (But App is On)

For the first example, let’s assume that an Uber driver is in his car in Florida. He has the app on. However, he hasn’t yet accepted a ride request. Therefore, he is not engaged in a ride.

Another car crashes into the Uber driver. Who pays the Uber driver’s lost wages?

In this instance, he would be entitled to 60% of her lost wages from Uber’s auto insurer. Specifically, the 60% of the lost wages would come from the Personal Injury Protection (PIP) coverage on Uber’s insurance policy. Florida Statutes 627.736(1)(b)

Very few states have PIP. Florida is one of the few states that requires Ubers to have PIP when the app is on, but the driver isn’t engaged in a ride.

Progressive currently insures Uber in Florida. This may change in the future. (James River Insurance Company used to insure Uber in Florida).

If the Uber driver wants to make a claim for loss of income, he or she will need to report the accident to Uber. Progressive will then assign a claim number and adjuster to the claim.

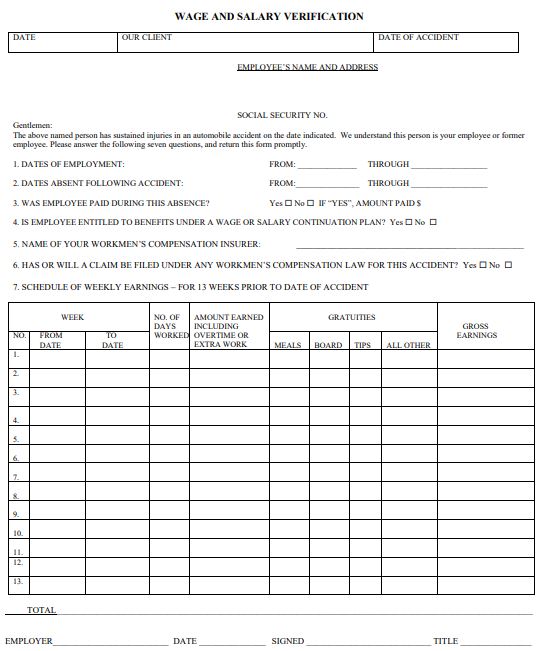

Progressive’s adjuster will ask the Uber driver to complete a wage and salary verification form.

What does that form look like?

Here is a screenshot:

I assume that Progressive has access to the Uber driver’s past salary info with Uber. Perhaps this will make the lost wage claim get paid quicker.

Progressive may want to take a statement (on the phone) from the Uber driver about how the accident happened. The Uber driver is required to give a statement to Uber’s insurance company.

However, the Uber driver should hire an attorney if another driver was at fault for the accident.

One of the benefits of a having an attorney is that the Uber driver will be prepared for the statement. He or she won’t be giving up valuable rights.

Can the Uber driver get paid for the 40% that PIP Insurance Doesn’t Pay?

Yes, but only if another driver’s negligence caused the Uber driver’s injury. In this instance, the Uber driver can also make a claim against the other driver for the remaining 40% of his lost wages.

Who pays an Uber driver’s lost wages if he is in an accident while en route to pickup a passenger or during trips?

So far I’ve just talked about accidents where the Uber driver was not engaged in a ride.

Who pays the Uber driver’s loss of income if she was hurt while engaged in a ride?

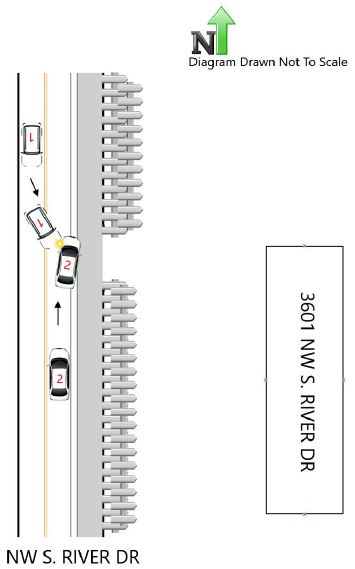

Let’s look at a real Uber accident claim. Someone used the Uber app to get a ride. Ray (an Uber driver) accepted the request. He picked up the rider. And on they went.

A van was heading in the opposite direction. The van made a left turn in front of the Uber driver. They crashed.

Here is the actual diagram from the crash report:

Ray did not call 911. Thus, paramedics did not come to the accident scene. Hours after the crash, Ray went to Coral Gables hospital. While there, he searched for an Uber accident lawyer. I’m happy to report that he found me. Shortly thereafter, he hired me.

He claimed that the crash caused his lower back pain.

Since the Uber driver was engaged in a ride, he was not entitled to PIP through Uber. Florida law doesn’t require PIP when an Uber isn’t engaged in a ride.

Here is a letter where Uber’s insurer (James River Insurance Company) said that PIP wasn’t available:

In this instance, the other driver needed to be at fault in order for the Uber driver to get paid for his lost wages.

Examples of fault could be if the other driver hit the back of the Uber, or if the other driver ran a stop sign. Those are just a few examples.

Does an at fault driver need to pay the Uber driver’s lost wages?

The at fault driver needed to pay the Uber driver’s lost wages in proportion to his percentage of fault. Let’s assume that the other driver was 100% at fault. In this instance, his insurance company owes the Uber driver 100% of his loss of income.

If the other driver was 50% at fault, his insurance company owes the Uber driver 50% of his loss of income. And so on and so forth.

I settled the Uber driver’s injury claim against the van’s insurance company. CNA insured the van.

I settled the Uber driver’s personal injury claim for $260,000. Most of the settlement was for pain and suffering.

This article has focused on lost wages. However, Uber drivers may be entitled to other compensation such as pain, suffering, medical bills and more.

The $260,000 settlement is just one of my many personal injury settlements.

Learn more about Uber accident settlements.

Are You an Uber Driver Who Was Hurt in a Crash in Florida? Or Were You Injured in another Type of Accident?

Call me now at (888) 594-3577 to find out for FREE if I can represent you.

We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if I Do Not Get You Money

We speak Spanish. Learn more about us. Check out my law firm reviews.

Leave a Reply