Personal Injury Protection (PIP) insurance can be a big benefit after an Uber car accident.

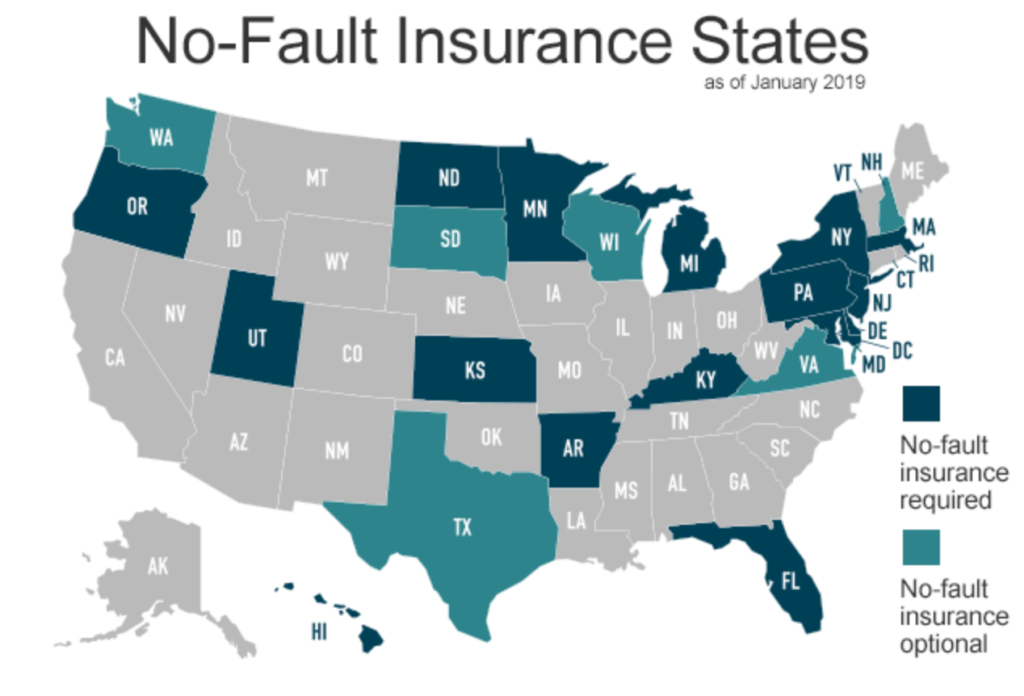

Several states have No-Fault laws. Just look at this map:

Each states’ No-fault laws are different. For example, in Florida, if you qualify for Personal Injury Protection (PIP), it could pay up to $10,000 of medical bills and lost wages. And got forbid someone dies in the crash, PIP pays a $5,000 death benefit.

If you’re in an Uber accident, you may be entitled to Personal Injury Protection (PIP) insurance. However, if you’re hurt as a passenger in an Uber vehicle in Florida, Uber won’t give you Personal Injury Protection (PIP) benefits. This is true regardless of whether you live in Florida or are an out of state resident who is injured in a Florida car accident.

If an Uber hits a pedestrian, Uber’s PIP won’t cover the pedestrian unless the Uber driver’s app was on but he wasn’t engaged in a ride.

Whether you are covered by PIP will depend on many factors, including but not limited to, whether you were driving an Uber vehicle or whether you were an Uber passenger.

Let’s look at several different scenarios.

Uber Drivers Get PIP if Waiting for a Ride

If an Uber driver was has the app on, but wasn’t engaged in a ride, the Uber driver gets PIP benefits. Florida Statute 627.748(7)(b)1.b.

In this instance, Uber’s insurance company would provide PIP benefits. Again, PIP covers lost wages and medical bills. Learn more about how Uber drivers get paid for lost income due to an accident.

Uber uses a different insurance company in some states. For example, in Florida, Progressive insures Uber.

Uber Drivers Don’t Get PIP if Engaged in a Ride

If an Uber driver is engaged in a prearranged ride, the Uber driver does NOT get PIP benefits through Uber.

In this instance, Uber’s insurance company would not provide PIP benefits. However, if the Uber driver purchased rideshare insurance, he or she may get PIP through the rideshare insurer.

Do Uber Passengers Get PIP Benefits from Uber?

No. Uber passengers won’t get PIP through Uber in Florida. This is because the law doesn’t require PIP on Uber vehicles when the Uber is engaged in a ride. If the Uber has a passenger, then by definition they are engaged in a ride.

On the other hand, Lyft gives PIP to passengers.

Passenger in an Uber Vehicle May Get PIP From His/Her Own PIP

However, passengers may qualify for PIP benefits through their own auto insurance. They may also qualify for PIP through a resident relative’s insurance.

Will Uber Pay PIP Benefits if an Uber Hits a Pedestrian?

In some cases, Uber’s insurance company may pay PIP benefits to a pedestrians hit by an Uber. For this to happen, the Uber needed to have the app on, but not be engaged in a ride.

“Pedestrians” include someone who is walking, bike riders, moped riders, roller bladers, skate boarders and more. Pedestrians also include someone on a Bird electric scooter.

However, Uber’s insurance is not the first in line to pay. The first source of PIP benefits is the pedestrian’s own car insurance policy. If the pedestrian doesn’t own a car, he or she may be covered if he or she lives with a relative who has PIP.

What happens if the pedestrian isn’t covered with PIP from either of those sources?

In that case, Uber’s insurer owes PIP benefits.

If the Uber is engaged in a ride and hits a pedestrian, Uber doesn’t owe the pedestrian PIP benefits. Florida Statute 627.748(7)(c)1.b.

Will Uber Pay PIP Benefits if an Uber Hits a Pedestrian Who Is Visiting Florida from Another State?

If an Uber hits a pedestrian who is visiting from another state, Uber won’t pay PIP benefits to the pedestrian. This is because people who are hit as a pedestrian while visiting Florida don’t qualify for PIP under a Florida law.

Uber won’t pay PIP benefits to a nonresident pedestrian even if the Uber’s app was on, but he wasn’t engaged in a ride.

If the pedestrian has medical payments (Medpay) benefits on his personal car, maybe they will pay benefits.

Can an Uber Driver, Who Is Driving an Uninsured Car, Get PIP Insurance Through The Car That His Child’s Mother Drives?

No. To answer this question, let’s use an example. Assume the following occurs in Florida.

Bob has exclusive control over a car. In other words, he is the only one who drives the car.

Bob’s girlfriend’s mom (hereinafter “grandma”) is the title owner. Bob lives with his girlfriend, Sara. They are the parents of a young child who they live with. The child is too young to drive.

The car is kept at Bob (and Sara’s house) and is uninsured. The grandma lives in a different house.

Bob doesn’t own or have any vehicles registered to him.

However, Sara has exclusive control over a car, which is owned and insured by grandma.

Bob does not get PIP through the insurance on the car that Sara exclusively drives, even though Bob is the child’s father (thus, he is a resident relative of the child).

Why Bob doesn’t get PIP through the car that Sara drives?

Since Bob doesn’t own a vehicle, or live with a resident relative who owns a vehicle then Bob is only entitled to PIP coverage from either of two sources.

Those sources are the vehicle that he:

- is occupying at the time of the collision; or

- is struck by, assuming the car crash occurs in the state of Florida.

Thus, unless Bob was in the insured vehicle owned by grandma he wouldn’t get coverage.

The good news?

If the Uber driver doesn’t get PIP, then he likely doesn’t need a threshold injury to be entitled to compensation for pain and suffering. This is big news because pain and suffering is often the biggest part of an injury settlement.

Also, if Bob was logged into the Uber app, but didn’t have a passenger, then Bob can get PIP through Uber. Uber’s are required to provide PIP in this instance. Florida Statute 627.748(7)(b)1.b.

James River Insurance Company, Uber’s insurer, would pay the PIP benefits.

Can an Uber Passenger Sue the At Fault Driver?

In addition to possibly getting PIP benefits, an Uber passenger may be able to make a personal injury claim against another driver. This assumes that the other driver was at fault.

Common examples of fault are if the other driver:

- Makes a left hand turn, and fails to yield the right of way

- Running a stop sign

- Hits another car in the rear.

The passenger may have a claim for compensation for:

- Past Lost Income

- Future lost income reduced to present value

- Past out of pocket medical expenses or medical liens

- Future medical expenses

- Replacement value of lost personal property (e.g. damage to your car, broken glasses, car seat, watch, etc.)

- Funeral expenses

- Reimbursement for mileage to and from medical appointments

- Past Pain and suffering

- Future Pain and Suffering

- Disability

- Scarring and disfigurement

- Mental anguish

- Loss of capacity for the enjoyment of life.

- Punitive Damages (in rare cases)

If the other driver is uninsured or underinsured, then the Uber passenger can make an uninsured motorist insurance claim with Uber’s insurer.

Uber’s insurance policy has a $1 million CSL uninsured/underinsured motorist insurance limit when engaged in a ride.

When looking for Uber accident lawyers, ask the attorney questions about how PIP works in an Uber accident. Question the attorney about PIP coverage in the particular state where you were injured. The lawyer should be able to answer the question without doing research. If not, this should be a red flag that they are not up to date with current rideshare laws.

You want an attorney who has a solid knowledge of how PIP applies in an Uber accident case.

Call Me Now!

Call me now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. I invite you to learn more about us.

Editor’s Note: This post was originally published on October 2015 and has been completely revamped and updated.

Leave a Reply