Can you recover a Personal Injury Protection (PIP) deductible from a tortfeasor after a Florida auto crash?

Generally, yes. Florida Statute 627.739(1) used to say that you could not recover the deductible. However, in 2003, the wording that said that you could not recover the deductible was removed.

The latest version of Florida Statute 627.739(1) is below. I have crossed out the wording that was removed.

“(1) The named insured may elect a deductible or modified coverage or combination thereof to apply to the named insured alone or to the named insured and dependent relatives residing in the same household, but may not elect a deductible or modified coverage to apply to any other person covered under the policy. Any person electing a deductible or modified coverage, or a combination thereof, or subject to such deductible or modified coverage as a result of the named insured’s election, shall have no right to claim or to recover any amount so deducted from any owner, registrant, operator, or occupant of a vehicle or any person or organization legally responsible for any such person’s acts or omissions who is made exempt from tort liability by ss. 627.730-627.7405.”

In order to recover the deductible from the tortfeasor, his negligence must have caused your injury.

As a practical matter, the tortfeasor would need to be collectible. This usually comes in the form of the careless driver’s bodily injury (BI) coverage in his auto insurance policy.

You can read my article on Florida PIP to learn what it is.

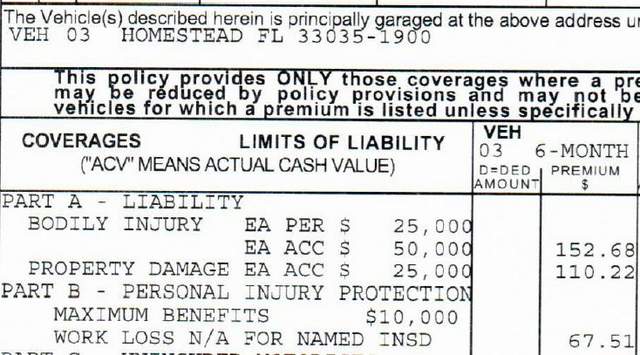

To better understand the above question, let’s first look at what a PIP deductible is. Let me explain by an example showing how a PIP deductible is applied.

Formula to Apply PIP deductible

Subtract the deductible amount from the medical bill. Then apply the 80% factor (see the example below). The same principles would apply to wage loss claims at 60% or replacement services at 100%. The deductible does not apply to the death benet.

(Medical bill – Deductible) x .8

So, let’s assume Mike rear ends you in Miami, Florida. If your medical bills are $6,000, and you have a $1,000 PIP deductible, then the PIP insurer would pay your medical providers $4,000.

(Medical bill – Deductible) x .8

($6,000 – $1,000) x .8= $4,000

You would then owe the medical providers $2,000. I arrive at this amount using the formula below.

Medical Bills – PIP payment = Amount owed to providers

($6,000 – $4,000) = $2,000

If the tortfeasor were 100% responsible for causing your injury, your economic damages against him would be $2,000. $1,000 of this $2,000 would be for your deductible.

If he has BI coverage, his auto insurer will likely pay you this $2,000.

You may also be able to make a claim for your non-economic damages, which are usually mostly composed of pain and suffering damages. In most Florida auto crash cases, you will need to meet the tort threshold to be entitled to pain and suffering damages. However, there are exceptions.

In a Florida car accident claim, the tortfeasor is usually the negligent driver or owner of the vehicle.

Court Wouldn’t Let Careless Driver Get a Reduction for Claimant’s PIP Deducible Since He Had a Permanent Injury

In Enriquez v. Clark, 692 So. 2d 941 – Fla: Dist. Court of Appeals, 5th Dist. 1997, Clark sued for Enriquez for negligence after their automobiles collided.

You should note that this case was decided before the language that said an injured person couldn’t recover his deductible was removed from the statute.

However, this is still a good case to send to the careless driver’s insurance company is they argue that they don’t owe you for medical bills that weren’t paid because you had a PIP deductible.

Clark had elected a PIP deductible of $2000. The jury returned a verdict in favor of Clark. They found Enriquez to have been 85 percent negligent. The jury found Clark 15% negligent. (This means that Enriquez only owed Clark for 85% of the full value of her case.)

Jury Awarded the Claimant $7,040

The jury specifically found that Clark had sustained a permanent injury and completed the damages portions of the verdict form as follows:

Past medical expenses: $4,740

Past lost wages: $800

Present value of future medical expenses: $1,000

Future lost wages: $0

Past pain, suffering, etc. $500

Future pain, suffering, etc. $0

______

Total: $7,040

Enriquez argued that the medical bills that he owed should be reduced by Clark’s $2,000 PIP deductible. The court said that because the jury found that Clark had a permanent injury, she could sue for pain and suffering under 627.737(2). Thus, the careless driver doesn’t get a credit for her PIP deductible.

In this case, this meant that Enriquez couldn’t subtract $2,000 from the bills that the $4,740 in past medical bills that the jury found that she owed Clark.

If any case, don’t let the careless driver’s insurance company argue that they don’t owe you your PIP deductible. This is true, whether the other driver is insured with GEICO, State Farm, Progressive, USAA, or even Uber or Lyft.

Can you Recover Your PIP Deductible if You Owned an Uninsured Car at the Time of the Crash?

If you own a car in Florida and do not have it insured, you may be able to recover your deductible. It may depend on the county where the auto accident happened.

Second District and Fourth District Allow you to Recover PIP deductible

There are fourteen counties governed by Florida’s Second District Court of Appeal, which include: Pasco & Pinellas, Hardee, Highlands, Polk, DeSoto, Manatee, Sarasota, Hendry, Hillsborough, Charlotte, Glades, Collier and Lee.

Florida’s Fifth District Court of Appeal is comprised of Hernando, Lake, Marion, Citrus and Sumter Counties, Flagler, Putnam, St. Johns and Volusia Counties, Orange and Osceola Counties, Brevard and Seminole Counties.

If your accident happened in one of the above counties, you can recover the PIP deductible.

Florida’s Third District and Fourth District Court of Appeals

Florida 3rd DCA handles appeals for Miami-Dade and Monroe County. Florida’s 4th DCA handles appeals from Palm Beach, Broward, St. Lucie, Martin, Indian River, and Okeechobee Counties.

In Florida’s Third and Fourth District Court of Appeals counties, I am unsure of whether you can recover your PIP deductible. I am currently looking into this.

PIP Deductible Doesn’t Apply if Victim Has an Accident With a Drunk Driver

If you’re in a car accident with a drunk driver, you do not have to meet your deductible or co-pay for any injuries. This assumes that the injuries are related to the crash. It also assumes that that you’re determined eligible according to the Florida Crime Victim Compensation Act.

This is true regardless of the county in Florida where the accident happened.

Call Me Now!

Call me now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. I invite you to learn more about us.