If someone’s negligence caused your injury, you may be entitled to recover damages. However, the liable party may deny liability.

In most personal injury cases, the negligent party has insurance. The liability claims adjuster will be the person who tells you that he or she is denying liability.

“Denying liability” means that the prospective defendant (or his insurer) says that they were not negligent. They say that they were not at fault.

Several elements make up a personal injury claim. They are insurance coverage, negligence, causation and damages.

Even if there is insurance coverage, and the accident caused your injury, you need to prove that the defendant was negligent. Basically, you need to prove that the defendant did something wrong.

What is the effect of an insurance company denying liability before a lawsuit in a personal injury case?

If an insurance company denies liability, they normally do not make a settlement offer. You need to decide whether to file a lawsuit in order to go forward.

What is the effect of an insurance company denying liability after you sue its insured?

When an attorney sues in most Florida personal injury cases, the attorney’s fee increases from thirty-three and one-third (33 1/3) percent to forty (40) percent of the total settlement. In addition, the cost to file a personal injury lawsuit in Florida is roughly $401.

Most attorney’s advance this cost. It is later paid back to the lawyer if, and when, you make a recovery. The most common type of recovery is through a settlement.

What happens if all defendants admit liability at the time they file their answer to your personal injury lawsuit?

If all defendants admit liability, you can request a trial only on damages. You still have to prove that the defendant’s liable act caused your injury.

Your attorney cannot charge a fee that is more than 33-1/3% of any recovery up to $1 million.

Is the claims adjuster generally correct when they deny liability?

Sometimes.

Claims adjuster’s liability denial may be right

There are certain cases where there is no liability as a matter of law. For example, you may slip and fall on a transitory foreign substance at a Florida business establishment.

If so, you may need to show that the defendant had notice of the dangerous condition, or that they had a negligent mode of operation.

Sometimes it is impossible to show that a property owner had notice of the hazard before your fall. When this happens, the insurance company may deny liability.

Claims adjuster’s liability denial may be wrong

An insurance company may denial liability in an injury case and later settle for fair value. They may also deny liability and later get hit with a big verdict.

Adjusters are taught to be persuasive when negotiating. Take what they say with a grain of salt.

My Actual Case: $300,000 Settlement for a man who slipped and fell on what he claimed was dirty water and smudges on a Sedano’s supermarket floor.

My client had a pre-existing Achilles tendon injury. I claimed that the fall at Sedano’s aggravated his pre-existing injury.

The accident happened in Miami, Florida. OptaComp was Sedano’s third party administrator (TPA) for personal injury claims.

The OptaComp adjuster denied liability. I sued Sedano’s.

In their answer to my lawsuit, they denied liability. We settled the case months later for $300,000.

Since they denied liability in their answer to my lawsuit, my attorney’s fee increased from 33 1/3% to 40% of the total settlement.

In my article “11 Reasons to Hire a Florida Injury Lawyer After an Accident“, I give several examples of some of my past cases where the insurer denied liability and we later settled for fair value.

Why do Insurance Companies Deny Liability?

Let’s look at my Sedano’s case to answer the question. Maybe the Optacomp adjuster and/or Sedano’s thought that I was not willing to sue.

I know several Florida personal injury lawyers who just handle cases before a lawsuit. They are unwilling to sue.

Maybe it was Optacomp (or Sedano’s) standard practice to deny liability in a case such as my client’s case. Maybe the adjuster genuinely thought that Sedano’s did nothing wrong.

Insurance companies can make a lot of money by denying personal injury claims. Many injured victims will just give up.

Does an insurance company sometimes deny liability and then offer to settle before you sue its insured?

Yes. Settlement is a moving target. As facts develop, an insurance company may deny liability but later make an offer. An insurance company may deny liability.

Sometimes sending the adjuster a witness affidavit that may establish liability can get them to make a fair offer.

I had this happen in a slip and fall case. My client fell in a hotel in Doral, Miami-Dade County, Florida. Zurich Insurance Company insured the hotel.

They denied liability and offered nothing. I sent the adjuster a witness affidavit that stated that a hotel employee mopped the area before the fall, but did not put a visible warning sign in the area.

My client claimed that accident caused her quadriceps (thigh muscle) tear. The adjuster later made an $18,000 offer from the commercial general liability (CGL) insurance coverage.

What is the Effect of the United States denying liability in your case?

Title 28 § 2675 says that you cannot sue the United States for money damages for injury or loss of property or personal injury or death caused by the negligent or wrongful act or omission of any employee of the Government while acting within the scope of his office or employment, unless the claimant shall have first presented the claim to the appropriate Federal agency and his claim shall have been finally denied by the agency in writing and sent by certified or registered mail.

If the agency does not make a final determination of a claim within six months after it is filed shall, at the option of the claimant any time thereafter, be deemed a final denial of the claim. You can then sue them.

Office Building Denies Liability in Slip and Fall in Bathroom Lawsuit; Court Awards Lady Full Damages

Bongiorno injured herself when she entered a restroom on the third floor of the property (the office building where Bongiorno worked) and slipped and fell on the unusually slippery floor.

Jennifer Bongiorno sued Americorp after she was injured. She was wearing 4 to 5 inch high heels at the time of the fall.

Americorp (the property owner) denied liability.

The court ruled that the injured worker was entitled to the entire verdict without a reduction for her alleged comparative negligence.

This case is Bongiorno v. Americorp., Fla: Dist. Court of Appeals, 5th Dist. 2015. Florida’s Fifth District Court of Appeal (DCA) issued its ruling on March 27, 2015.

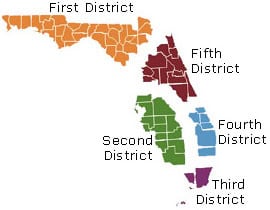

Florida’s Fifth District Court of Appeal is comprised of Hernando, Lake, Marion, Citrus and Sumter Counties, Flagler, Putnam, St. Johns and Volusia Counties, Orange and Osceola Counties, Brevard and Seminole Counties.

Did someone’s carelessness cause your injury in an accident in Florida, or on a cruise or boat?

We want to represent you!

We want to represent you if you were hurt in an accident in Florida, on a cruise ship or boat. If you live in Florida but were injured in another state we may also be able to represent you.

Call Us Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.

I have asked about handful of attorneys this question them seem to scratch there head on this one.

If a insurance co. Accept liability for property damage and bodily damage write u check for property tells when your done with medical they will review and then make you offer .. but year later after treatment is done they denied you all of the claim.. ??