I am going to discuss burst fracture settlements. We’ll look at how to calculate how much a burst fracture is worth.

First, I want to quickly explain what a burst fracture is.

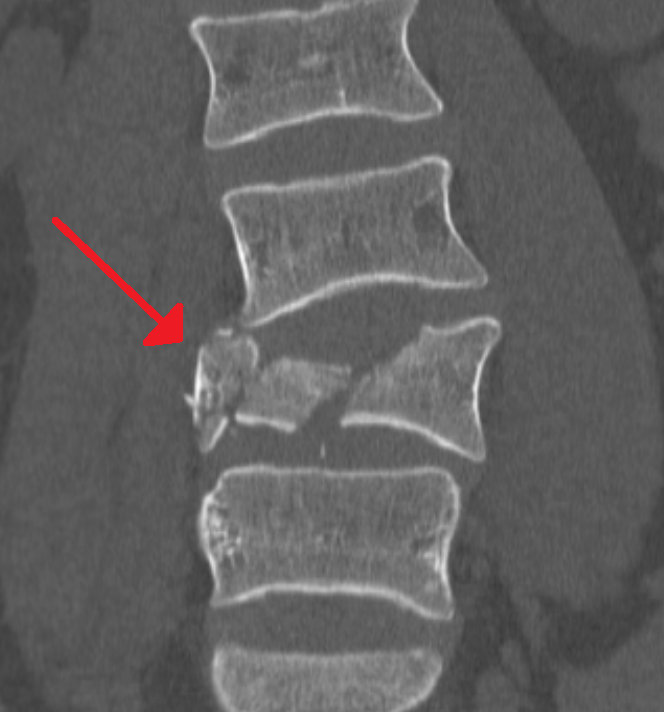

If the vertebral body is crushed in all directions it is called a burst fracture. The term burst implies that the margins of the vertebral body spread out in all directions.

A burst fracture is a much more severe injury than a compression fracture.

Is a burst fracture worth more than a compression fracture?

All things equal, burst fractures have a higher pain and suffering value than compression fractures. This is because it is a more severe injury than a compression fracture.

Thus, the full value of a burst fracture case is worth more than a compression fracture. All things equal, a burst fracture is worth more than a herniated disc.

A burst fracture is an injury to the spine in which the vertebral body breaks due to immediate and severe compression. They typically occur from severe trauma, such as a car accident or a fall from a height. A burst fracture can also be caused by a motorcycle accident. Or truck accident.

With a great deal of force vertically onto the spine, a vertebra may be crushed. Pieces of the vertebra shatter into surrounding tissues and sometimes the spinal canal.

What is the full value of pain and suffering of a burst fracture?

All things equal, a burst fracture (with surgery) is worth much more than without surgery.

To get the value, I’ve looked at past Florida personal injury verdicts for spinal fusion cases. Thus, the full value of pain and suffering for settlement purposes is as follows:

- Burst fracture (with 2 level spinal fusion): $250,000 to $400,000

- Burst fracture (with 4 level spinal fusion): $300,000 to $500,000

For a 4 level burst fracture, the pain and suffering value could even be more than $500,000 in certain cases.

How did I arrive at those settlement amounts?

Both of the above ranges are for burst fractures with surgery. Surgery increases the full value of any personal injury case. And this is true with burst fractures.

Without surgery, a burst fracture isn’t worth as much.

As you can see pain and suffering values for burst fractures are high. This leads me to the biggest problem with burst fracture cases.

What is it?

There often isn’t enough bodily injury liability (BIL) insurance to cover the value of a burst fracture case. This same problem often happens in cases involving a broken leg, tibial plateau fracture, skull fracture or brain injury case.

Many Florida car owners driver cars that are uninsured. And even if they have insurance, the bodily injury liability limits are often only $10K or $20K.

That amount of insurance won’t cover the full value of a burst fracture case.

If You Have a Surgery on a Burst Fracture, Is Your Injury Considered Permanent?

In most Florida car accident cases, the injured person needs a permanent injury to get money for pain and suffering.

All things equal, a jury is more likely to consider a burst fracture to be a permanent injury if you’ve had surgery. The more major the surgery, the more likely that a jury will consider it to be permanent.

And if a jury would consider it permanent, then there is a good chance that the responsible insurance company would also. This often triggers a higher settlement offer.

Take, for example, someone who is in a car accident and has a burst fracture. If he or she has surgery to the fix the burst fracture, doctors are more likely to say that the injury is permanent.

When it comes to spinal fusion surgery, the more levels that are fused, the higher the likelihood that a jury believes that the injury is permanent.

Let’s assume that the injured person has a three or four level spinal fusion surgery as a result of a burst fracture (or other fracture).

Having a four (or more) level fusion is a lot of restriction. It negatively affects your ability to function.

In this case, a jury is more likely to believe that is a permanent injury as compared to a one level fusion. However, even with a one level fusion, many jurors are likely to consider the fusion to be a permanent injury.

For settlement purposes, the pain and suffering value of a two level back or neck fusion surgery is likely less than a four level fusion surgery. A four level fusion surgery is a major surgery.

Does a Pedestrian Who is Hit by a Car and Suffers a Burst Fracture Have a Good Case?

Yes, if the pedestrian was in a crosswalk, and the driver has enough BIL insurance. Even if the pedestrian wasn’t in a crosswalk, he may still have a good case.

The pedestrian’s case becomes harder if the accident happened at night, and the pedestrian wasn’t in a crosswalk. Some of the biggest pedestrian accident settlements are for burst fractures.

If the pedestrian was hit while drunk or on drugs (and not in a crosswalk), the pedestrian’s case may be tougher. But is still may be winnable.

How Do Uber and Lyft Handle a Burst Fracture Cases?

Uber and Lyft passengers will likely have more than enough insurance to cover the value of their burst fracture case. This is true even if the injured person has surgery on the burst fracture.

This is because passengers of Lyft and Uber are covered up to $1 million for personal injuries. Most burst fracture cases are worth under $1 million.

What happens if a Lyft passenger suffers a burst fracture, and has a 2 level (or more) fusion surgery?

If the other vehicle was at fault and is uninsured, then Lyft’s auto insurer should quickly pay the Lyft passenger Lyft’s $250,000 uninsured motorist (UM) insurance limits. (This assumes that the Lyft passenger doesn’t have his own (big) UM insurance policy.)

Lyft’s insurer should quickly pay because the settlement value of a burst fracture (with a 2 level fusion) is worth more than $250,000.

Will the At Fault Driver Have An Umbrella Policy to Cover Your Burst Fracture?

Let’s assume that the at fault driver’s bodily injury liability (BIL) insurance limits aren’t enough to pay for the fair value of a burst fracture. This is usually the case in Florida, where (sadly) BIL insurance isn’t required on most cars.

For purposes of this hypothetical, I’ll assume that other than the at fault driver, there aren’t any other parties to sue. I’ll also assume that the injured person doesn’t have uninsured motorist (UM) insurance.

How do you know if the at-fault driver will have an umbrella insurance policy?

I recently heard a GEICO sales agent say that GEICO doesn’t sell umbrella policies unless their insured has a $250,000 per person/$500,000 per accident (or higher) BIL insurance on their car.

Therefore, if the at fault driver has limits that are lower than $250,000 per person, don’t expect the at fault driver to have an umbrella insurance policy with GEICO. Perhaps they have umbrella insurance from another insurer.

What if the at fault driver – who GEICO insures – has $250,000 per person BIL insurance limits or higher?

In this case, there is a greater likelihood that the at fault driver has an umbrella policy.

I assume that other umbrella insurers (like State Farm, Allstate, USAA, Progressive) have a similar rule.

I am a Miami lawyer that represents people with burst fractures (and other injuries) anywhere in Florida. Regardless of where your accident happened in Florida, I am able to represent you.

Considering Hiring a Lawyer for an Injury in Florida? Call Me Now!

Call me now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.