My actual case: $73,000 Settlement for my client, a lady, who tripped and fell at a condominium.

We did not charge an attorney’s fee on an additional $5,000 that the insurance company paid for Medpay benefits.

The “accident” happened in Sunny Isles, Miami-Dade County, Florida. $73,000 of the total settlement was from the condo’s personal injury coverage.

$5,000 of the total settlement was from its medical payments (Medpay) coverage. She fractured her nose.

Liability

As you can see from the picture above, the door did not have a warning sign on it. There is no requirement for an exit door to have a warning sign on it.

However, in my opinion a door that opens to a landing area that has a large height differential (7 inches in this case) should have a warning sign on it because this is reasonable. In Florida, a condo has a duty to act reasonably.

This was a door in the common area – an area available to all residents and visitors – of a condominium. When our client exiting the building, there was a large step down that she said she did not expect.

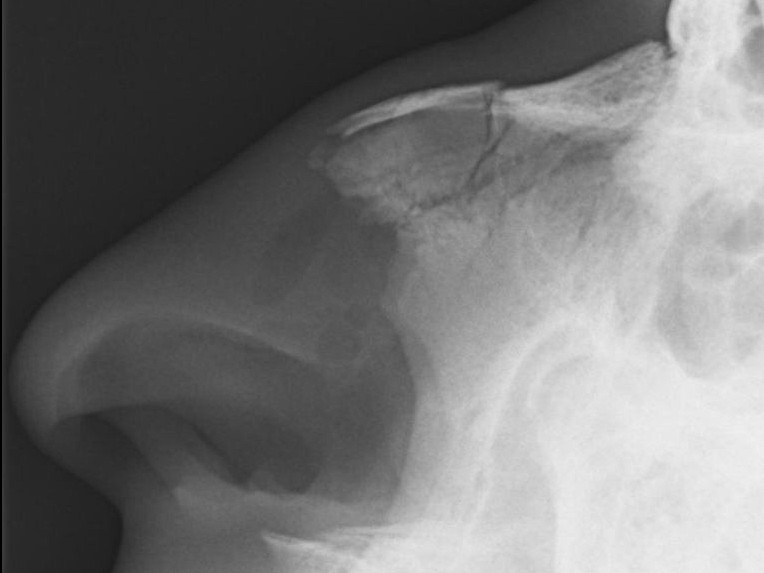

See the picture below.

In Florida, a condominium, apartment building and property manager have two duties that are owing to invitees:

1. to use reasonable care in keeping and maintaining the premises in a reasonably safe condition; and

2. to give the invitee warning of concealed perils which are known or should be known to the landowner, and which are unknown to the invite and cannot be discovered by him through the exercise of due care. Friedrich v. Fetterman and Associates, P.A., 137 So. 3d 362 (Fla. 2013).

I sent the above picture to a construction project manager, who confirmed that it was not reasonable to not have a warning sign.

The fact that there was a large step down, that our client had testified that she was unaware of, helped our case.

In a case like this, a larger unexpected step down generally puts less fault on the claimant. My assistant went to the incident scene and she met our client there.

My assistant measured the height differential. See the picture below.

My assistant took a close up of the ruler, which showed that the height differential was 7 inches.

After our client fell while exiting the door, she continued to fall down several steps below. See the picture below.

Damages

She was taken to the emergency room after the fall. She was diagnosed with a fractured nose. She had surgery on her nose in another country. She had bruising throughout her body.

She made a good recovery. Accident happened in Miami Beach, Florida. Client was from another country. The claim was paid by Scottsdale Insurance Company, the liability insurer for the condominium complex.

The condominium complex had a $1 Million dollar liability insurance policy.

My thoughts: As in any case where someone falls at a condominium complex, the condo had plenty of liability insurance to cover my client’s injuries. This was a great result for my client.

Her emergency room treatment at the hospital in Miami Beach, Florida was paid by Assist Card (a provider of travel insurance). Unlike many health insurance companies, Assist Card did not have a right of subrogation.

They did not ask to be paid from the settlement. The liability insurer for the condominium complex did not ask whether the travel emergency medical insurance company had a right to be paid back.

As soon as I received medical records and bills, I forwarded them to the liability insurance company. We do our best to do this in every case.

The sooner that liability insurer receives medical bills and records, the sooner that they can set or increase its reserves in the claim. This is particularly important in a case where there is plenty of liability insurance.

I have found that it is much better to send medical records and bills to the liability insurance company as soon as I receive them.

I sent my assistant to take pictures of the accident scene in case it were to change. I sent Scottsdale Insurance and the condominium a written request to preserve (keep) any video surveillance that may have captured the fall.

The claims adjuster from Scottsdale Insurance asked me to have the medical records (in Spanish) translated to English. I hired a reasonably priced translator to translate the medical records and bills.

The Scottsdale adjuster told me that Scottsdale would not pay to have the records translated. In Florida, when deciding how much your case is worth, most of the time the liability insurer does not care whether or not you have to pay back the health insurance company.

The liability insurer mainly cares about the amount of money that the health insurance company paid for your medical bills. This is because in most cases you can make a claim against the condominium complex for the amounts paid by your health insurance to your medical providers.

Because she had surgery to her nose in her home country of Colombia, the bills were much smaller as compared to if the surgery had been done in Miami. Our client’s out of pocket medical bills were $3,000.

She did not claim lost wages. How did I arrive at the $73,000 settlement?

I used the settlement formula that I use in every case to calculate the full value of the case. It is:

Settlement Value = (Pain and Suffering) + (Lost Wages) + (Medical Bills)

Then, I plug-in the numbers. It his particular case, I assigned $75,000 to the pain and suffering component of her claim because she had nose surgery. Why did I choose $75,000? It comes with 10 years of experience evaluating claims and looking at jury verdicts. It was a reasonable number for this case.

If she would not have had surgery, then I would have assigned a smaller number to the pain and suffering component. I then plug-in the numbers.

Full Value = (Pain and Suffering) + (Lost Wages) + (Medical Bills)

Full Value = $75,000 + 0 + $3,000

Full Value = $78,000

The next step would be to reduce the full value by the claimant’s percentage of fault. Since I did not feel that she was at fault, I did not reduce the full value of this case. This case is an example of the fact that foreigners who are injured while in Florida have the same rights as people who live in Florida.

I have to compliment Scottsdale Insurance Company for agreeing to settle this case before a lawsuit was filed. I consider Scottsdale Insurance Company one of the best insurance companies when it comes to fairly paying claims.

Did someone’s carelessness cause your injury in an accident in Florida, or on a cruise or boat?

See Our Settlements

Check out some of the many Florida injury cases that we have settled, including but not limited to car accidents, truck accidents, slip or trip and falls, motorcycle accidents, drunk driving (DUI) accidents, pedestrian accidents, drunk driving accidents, taxi accidents, bicycle accidents, store or supermarket accidents, cruise ship accidents and much more.

We want to represent you!

Our Miami law firm represents people injured anywhere in Florida in car accidents, truck accidents, slip, trip and falls, motorcycle accidents, bike accidents, drunk driving crashes, pedestrian accidents, accidents involving a Uber or Lyft Driver, cruise ship or boat accidents and many other types of accidents.

We want to represent you if you were injured in an accident in Florida, on a cruise ship or boat. If you live in Florida but were injured in another state we may also be able to represent you.

Call Us Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you. We answer calls 24 hours a day, 7 days a week, 365 days a year.

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us.

Leave a Reply