Below is a settlement of mine for a bicyclist who was hit by a pickup truck.

Settlement: $100,000

Before deduction for attorney’s fees and expenses. Most cases result in a lower recovery. It should not be assumed that your case will have as beneficial a result.

Case type: Personal Injury, Pickup Truck hit Bicyclist

Jurisdiction: Broward County/Florida

Settlement Date: 2008

Claimant’s Atty: Justin Ziegler

Insurer for Pickup Truck Driver/Liability Claims Adjuster:

Parties:

My client was a middle-aged woman who was retired at time of accident.

Insurer for trucking company was USAA Insurance.

Summary:

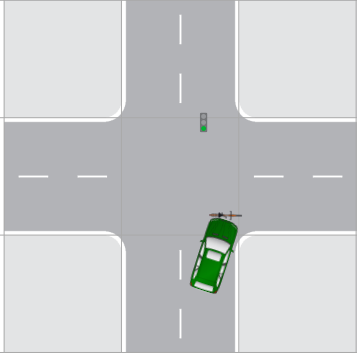

My client was riding a bicycle, at night, in Cooper City, Florida. She was struck by a pick-up truck. A diagram of the accident is above. The bicyclist was airlifted to the hospital. There was one witness, but he did not observe the crash occur.

The police officer noted that the bicyclist was wearing a dark brown shirt and dark blue sweatpants.

The clothing was significant because the pick-up truck driver could try to place blame on my client by arguing that she could not see the bicyclist because the bicyclist’s clothes were so dark and it was dark outside.

If you are a pedestrian or bicyclist at the time of a car accident when it is dark outside, wearing dark clothes is one of the many factors that may lower the settlement value of your case.

Police saw a flashlight near the bike

Police observed a flashlight near the bicycle at the accident scene. The flashlight was not activated. If you are a bicyclist and you are riding a bike at night, using a flashlight at the time of the accident may help your case.

This is because you can argue that the truck driver or car should have seen the flashlight and should have avoided the accident.

The pick-up truck driver said she stopped and looked both ways before entering the intersection and that she never saw the bicyclist. There were no crosswalks or pedestrian activated controls.

Claimant’s Injuries Damages:

The bicyclist sustained serious injuries but she survived. When the police officer arrived at the scene, she was unconscious. Rods (metal plate) and/or pins were put inside her face.

She had significant scarring and disfigurement to her face and trunk (“abdomen”). She had multiple fractures of her face, wherein at least five (5) screws are permanently inserted.

The bones of the face are illustrated below.

She also had procedures done to fix her two collapsed lungs.

She had a tube inserted into her chest. This procedure is called a tube thoracostomy. This is done into the pleural cavity to drain air, blood, bile, pus, or other fluids.

She had some eye issues. She spent several days in the hospital.

She received physical therapy, IVs, loads of heavy-duty pain medication, several CT scans, anesthesia and much more.

Policy Limits for Bodily Injury (BI) Liability Insurance (USAA) that covered the pick-up truck:

One hundred thousand dollars ($100,000) in BI liability coverage.

Uninsured motorist (UM) insurance coverage

My client did not have any uninsured motorist (UM) insurance. Unfortunately, UM insurance is not required in Florida.

The settlement likely would have been larger if my client was insured under a UM policy.

Settlement Details:

USAA paid its BI liability limits of $100,000, which is what the case settled for. Her hospital bills alone were over $100,000 but I was able to get the hospital to accept $33,333 as final settlement of her entire balance.

This case does not give a good idea on the settlement value of her injuries because there was limited BI insurance available. She could only collect $100,000.

My client did not own a car at the time of the crash. She was living at a family member’s house at the time of the accident.

GEICO insured the family member.

If she would have owned a car, her own PIP would have paid $10,000 of her medical bills. But because she did not own a car, her resident relative’s PIP paid the hospital $10,000 for medical bills.

Breakdown:

It was my position that pick-up truck driver was liable for violating Plaintiff’s right of way. The insurance adjuster really did not make any arguments because my client’s injuries were so big and the liability insurance was so low relative to the injuries.

My client’s medical bills alone may have justified receiving the $100,000 policy limits from USAA. Therefore, I can’t give a breakdown as to how much of the settlement was for pain and suffering vs. how much was for medical bills.

Other comments:

The case settled pre-suit (before a lawsuit) just a few months after the accident. If there is limited liability insurance in a personal injury case then sometimes the case may settle faster.

BI liability insurance is not required on most Florida vehicles. Therefore, Florida car owners usually have limited BI liability insurance. Therefore, car accident cases, as a whole, settle quicker than other types of accidents.

Check out some of the many personal injury cases in Florida that we have settled, including but not limited to car accidents, slip and falls, and cruise ships accidents.

We want to represent you if you were injured in an accident in Florida, on a cruise ship or boat. If you live in Florida but were injured in another state I may be able to represent you as well.

Call us now at (888) 594-3577 to Get a Free Consultation. There are No Fees or Costs Unless We Recover Money. Call us 24 hours a day, 7 days a week, and 365 days a year. We speak Spanish. We invite you to learn more about us.