Here are 20 questions that insurance adjusters don’t want you to ask in personal injury claims and other types of claims.

1. How do you rank for average claim payouts (ALP)?

At least one insurance company ranked claims adjusters in different percentiles for their average loss payout (ALP). Loss is just another word for claim.

Several years ago, someone sued GEICO for allegedly acting in bad faith. This is not my case. GEICO turned over some of its adjuster personnel files.

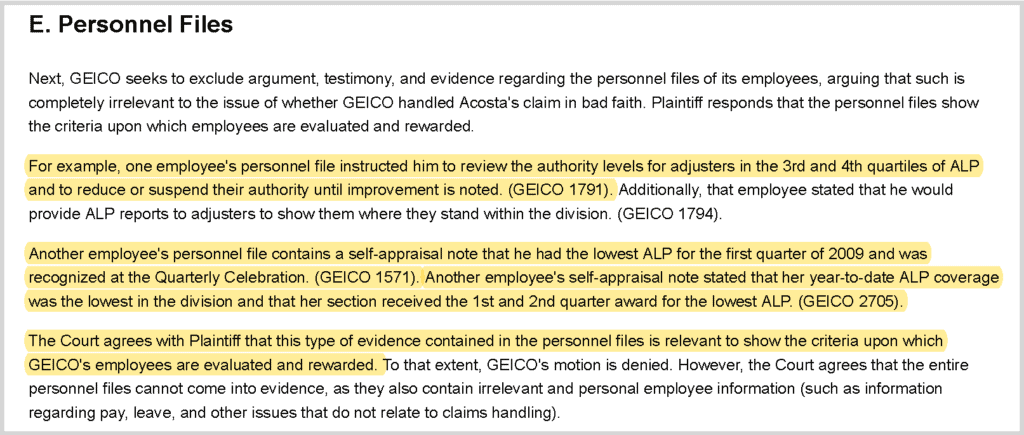

In one case, the court said that one GEICO employee’s personnel file instructed him to review the authority levels for adjusters in the 3rd and 4th quartiles of ALP.

Here is part of that court order:

Basically, the employee was told to reduce or suspend their authority until improvement is noted.

The attorney who sued GEICO argued that GEICO was trying to get its adjusters to pay less so that they moved to a higher payout percentile.

Now, in fairness to GEICO, they won this case at trial. The parties then settled.

Nevertheless, we now have a better idea of how GEICO operates.

Now:

Adjusters will tell you that they are mainly evaluated on how quickly they make first contact with the injured party, witnesses, etc. However, I believe that the average payout amount is a huge factor in how quickly adjusters get promoted.

2. Is your settlement authority double your first offer?

I heard that one of the largest insurance companies in the United States gives its adjusters double the settlement authority of the their first offer. For example, if their first offer is $10,000 to settle your injury case, they may be able to settle for $20,000.

If the adjuster won’t offer you two times their first offer, you may consider asking him if their insurance company lets them offer two times their opening offer.

3. Where can I learn about how you handle claims?

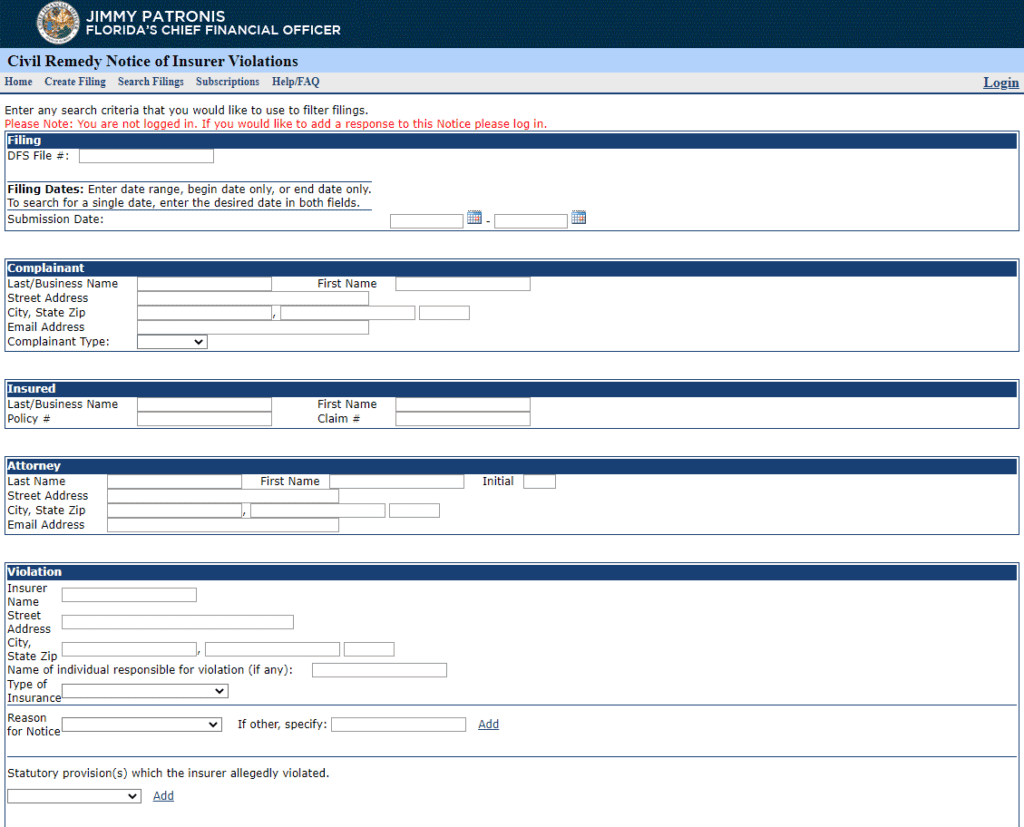

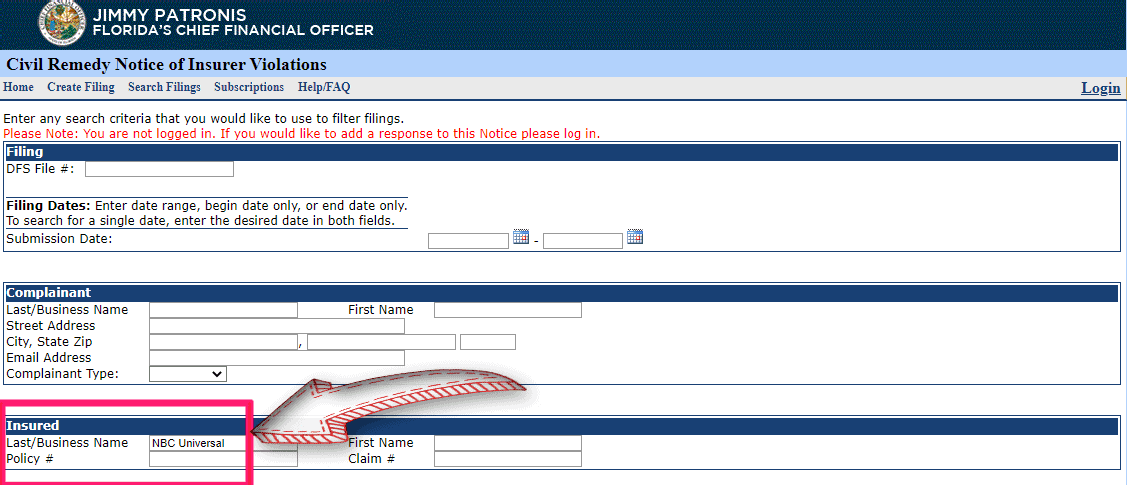

In a state like Florida, you may be able to see some of a particular adjuster’s past claims. To do so, go to Florida’s Civil Remedy Notice of Insurer violations website.

You’ll only be able to view claims where someone or their lawyer filed a civil remedy notice against an insurance company (and adjuster).

The page looks like this:

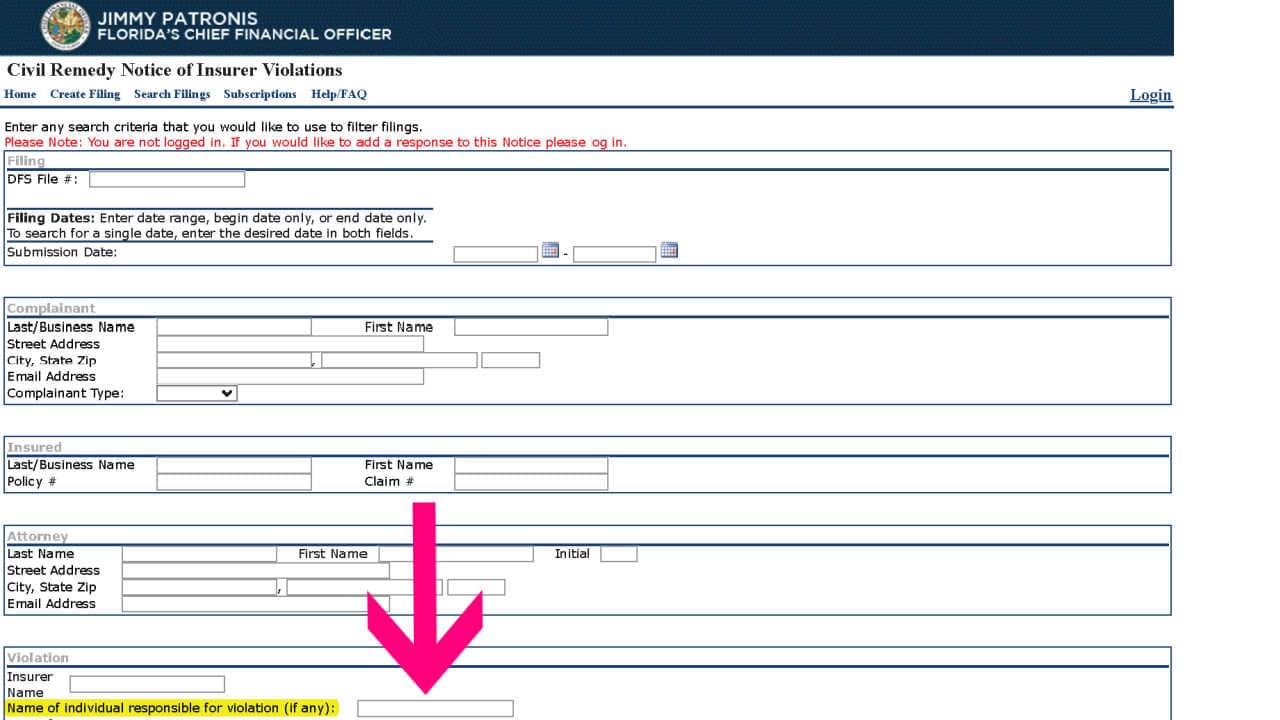

Here, you enter the adjuster’s name in the field that says “Name of individual responsible for violation (if any):

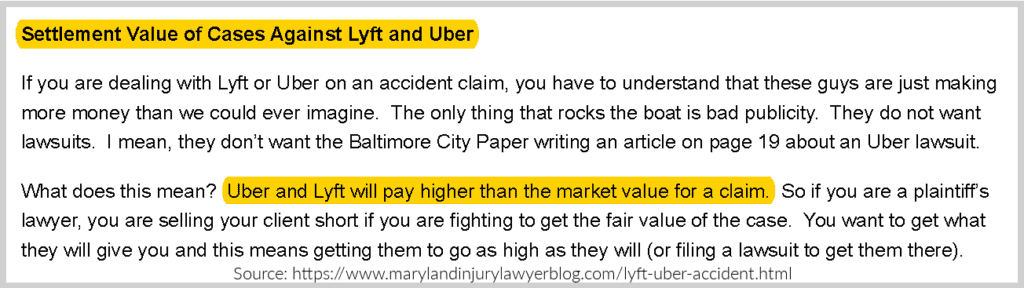

For example, lets say that you were in an Uber car accident. And you’re happy to hear that a personal injury lawyer said that Uber and Lyft will pay higher than the market value for a claim.

You want to learn more about how the adjuster assigned to your case handles claims. Just search for that adjuster in the CRN search website.

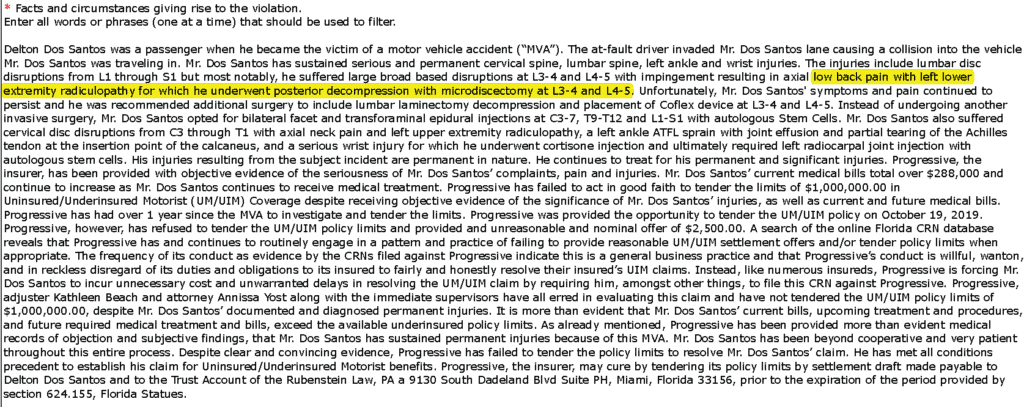

Let’s look at an Uber car accident case. Dos Santos was passenger in an Uber ride.

The Uber Passenger Lower Back Surgery

After the crash, she underwent back surgery. Progressive insured Uber. Her Miami attorney demanded the $1 million uninsured motorist coverage limits.

According to her lawyer, Progressive was given the chance to to pay the $1 million UM limits. Yet, they only offered $2,500!

Here is a screenshot of part of the CRN:

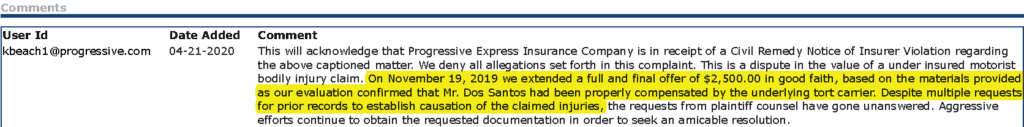

You can see Progressive’s response here where they only offered $2,500:

What if you know the name of the defendant but you don’t know the name of the insurance company?

For example, let’s say that you were injured at Universal Studios in Orlando. You think that they were careless and caused your accident.

Here is how you can see how they handle claims. You’ll need to know the legal name of the party who you believe caused your injury.

Where it says “Insured”, type in “NBC Universal”.

This should bring up a couple of results of people whose attorneys have filed civil remedy notices in Florida. Basically, these attorneys are claiming that Universal’s claims company has failed to fairly pay them for their injury claims. You’ll also get to see Universal Studios’ responses to the claims.

In Universal Studio’s most recent response to a civil remedy notice, Chubb Insurance says that Helmsman Management Services, a division of Liberty Mutual, is the third party administrator for Comcast NBCUniversal (NBCUniversal) regarding their General liability claims.

4. How much did you request authority to settle for?

Often times, adjusters often need to request settlement authority to settle your case. Basically, they need their claims managers approval to make you an offer.

Some adjusters have check writing authority without getting approval. But times have changed. I heard from a former adjuster that one of the largest car insurance companies in the United States cut its higher level adjusters authority from $100,000 to $10,000!

These adjuster used to be able to settle for $100,000 without approval. But now they need to get their supervisor’s approval to make an offer over $10,000.

An adjuster will rarely tell you how much they money they requested from their supervisor. On rare occasion, I’ve had an adjuster tell me.

In one case, the policy limits were $125,000. My client had a deep bone contusion in his arm (humerus). The adjuster told me that she asked her supervisor to let her settle for the $125,000 limits. She told me that management denied her request.

Unfortunately, she wouldn’t offer above $18,000. So I sued her insured. During the lawsuit, we settled for $25,000. That was the fair value of the case.

5. What can I do for you to pay me more in my case?

An adjusters job is to quickly settle their cases for as little as possible. The longer that your case stays open, the more cases the adjuster has open. In insurance company terms, an open case is called a “pending” claim.

Adjusters want to keep their amount of pending claims low. Therefore, they are not likely to give you strategies to help build value in your case.

Why not?

Because that would keep your case open longer. And with adjusters being overwhelmed, they don’t want your case open longer.

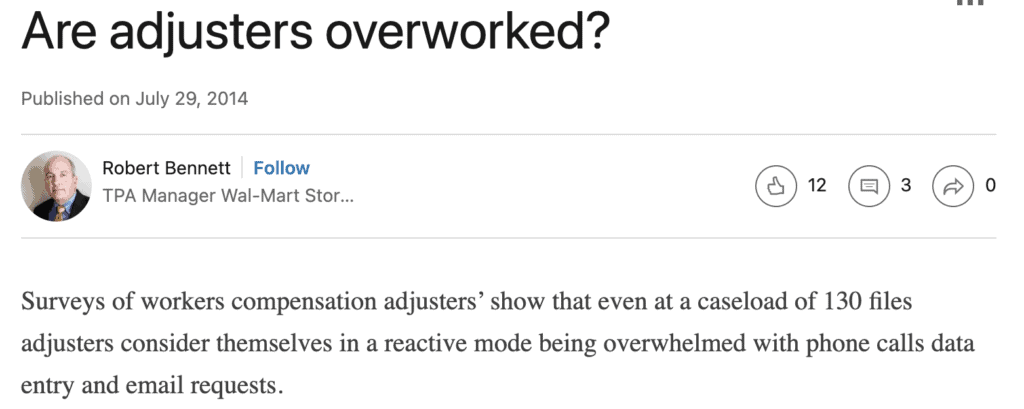

According to a third party administrator for Walmart, surveys show that adjusters are overwhelmed:

That said, from time to time adjusters may tell you things that may get you a higher offer. For example, they may say:

I need this hospital bill.

The adjuster is saying that he or she may offer you more money if you get them this bill.

Or if you are claiming that an accident caused your brain injury, they may say:

You haven’t treated with a neuropsychologist or neurologist.

Basically, they are implying that if you treat with one of those specialists, it may help them get authority to make you a higher offer.

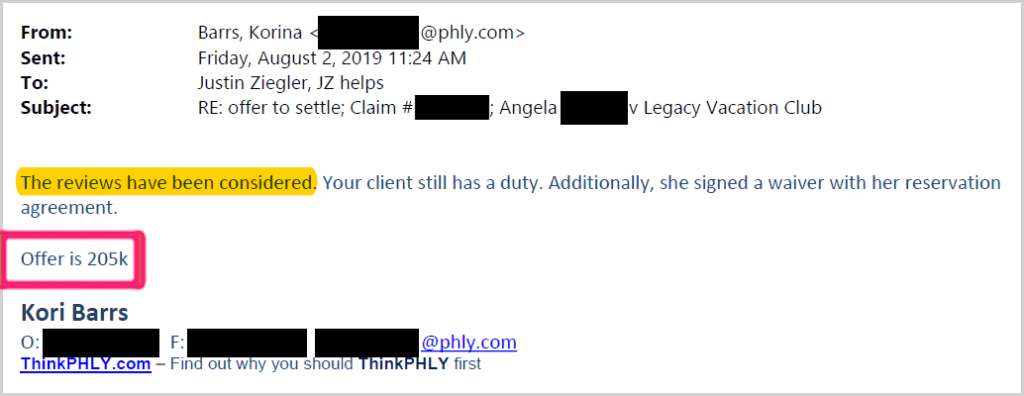

If you’re injured at a hotel or mall, don’t expect the adjuster to tell you that you can look at Google or Tripadvisor reviews online for past complaints of the same hazard that caused your injury.

If you are able to find similar complaints of the same dangerous condition, may get you a bigger payout.

I’ve done it before in a hotel slip and fall case.

6. How much are you allowed to offer me?

You will never know how much the insurance adjuster has authority to offer you. This is true even after you settle your case.

The adjuster will likely tell you that the settlement amount was their top authority. Often times, this simply is not true.

But the last thing that an adjuster wants is for you to try to wiggle out of the settlement.

The one time when the adjuster will tell you how much they were able to offer you is when you are settling for the policy limits. This is because they are paying you the maximum that they have to under the insurance policy.

Likewise, don’t expect the adjuster to tell you to request the 911 call. Sometimes the other driver will admit fault. That can add big value to your case.

7. How often do you settle for your top authority in under 3 moves?

An insurance adjuster told me that his supervisor told him to never settle a case is less than 3 moves. This adjuster worked for one of the largest insurance companies in the world.

All insurance companies use that negotiating strategy. By not settling a case is under 3 offers, there is a chance that the injured person gets negotiation fatigue. When this happens, you’ll make the mistake of settling an offer in under 3 moves.

Bottom line:

Never settle a case is under 3 counter offers. This is true unless you are getting offered the insurance policy limits. In that case, you may need to accept the insurance limits.

Never tell the adjuster that you want an amount

Always tell them that you need an amount. It is a much stronger negotiation tactic. It makes you seem like you require a certain settlement amount.

8. Do you like to pay out less for claims?

Insurance companies like to pay out as little as possible for personal injury claims. Want proof?

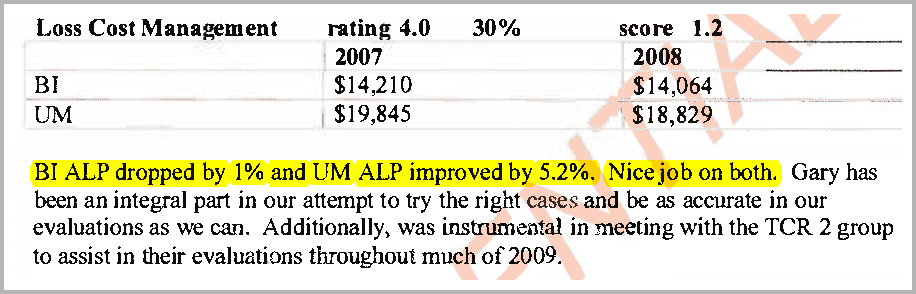

This is a GEICO internal document that was turned over in a bad faith accident case against GEICO.

The GEICO Regional Claim Manager’s self appraisal report showed that he was happy that the average loss payout went down as compared to the year before.

Specifically, GEICO’s average claim payout for uninsured motorist insurance claims dropped by 5.2% compared to the year before.

Take a look:

BI means bodily injury claims. UM is uninsured motorist claims.

9. Are you going to fight my case?

Insurance adjusters often start off being friendly in your claim. They want to get your recorded statement. The insurance company will assign you a claim number. This doesn’t mean that they have agreed to pay your claim.

When you send the adjuster records or medical bills, they may say “Thank you for sending the records. Have a nice day.” Again, this does not mean that they have agreed to pay your claim.

In fact, I’ve dealt with friendly adjusters who have later denied my client’s case. We then have to sue if the case warrants it and my client is willing.

Or maybe the adjuster accepts liability but argues that the accident did not cause your injuries. They may argue that you had your injury before the accident.

10. Are you using software to tell you how much my case is worth?

It’s no secret that most insurance companies use claims software to tell them how much it thinks a case is worth. In that past, GEICO has used Mitchell ClaimIQ.

Allstate has used Colossus.

During the course of your claim, some insurance companies will send you a letter telling you that they are using software to help them evaluate the claim value. I’ve seen Allstate letters that say this.

11. What Are the Insurance Limits?

Insurance claims adjusters don’t want you to ask, “What are the insurance limits in the case?“

They don’t want you to ask this question because it shows that you may be trying to make a claim for the entire insurance limits. It also shows that you’re smarter than your average claimant.

If insurance companies can do so, they want to avoid paying out the insurance policy limits. They want to pay as little as possible.

12. How Much Check Writing Authority Do You Have?

Another question that bothers claims adjusters is if you ask them, “How much check-writing authority do you have?”

You’re essentially asking them, how much can they write a check for without having to get supervisor approval. They may not want to answer that question because once you have this information, you will know if this adjuster has the authority to satisfy your settlement demand.

If you think the value of your case is above their check-writing authority, you’d need a new adjuster assigned to your case.

The current adjuster wants to keep your claim.

13. How Much Is the Reserve?

Insurance claims adjusters don’t like being asked is, “What is the settlement reserve?“

The reserve is an amount of money that an insurance company sets aside to pay your case. The adjuster doesn’t want to be asked what the amount of the reserve is because if they tell you then you have a better idea of how much they think your case may be worth.

14. How Much Have You Paid in the Past for My Same Injury?

Claims adjusters don’t want you to ask how much they’ve paid to other claimants for the exact injury that you have.

Insurance companies keep tabs on how much they’ve paid for pain and suffering for certain injuries. You’re not going to have access to those settlements.

If you ask the insurance adjuster how much he’s/she’s paid in the past for pain and suffering for your same injury, he’s not going to tell you. If he/she does tell you, the number that he gives you is gonna be much lower than what he’s actually paid.

Adjusters rarely like to talk about their past settlements with claimants. The best thing that you can do would be to look up past settlements and verdicts using a jury verdict search reporter.

It likely won’t give you the exact settlements and verdicts with that particular insurance company. It’s going to give you a ballpark value of the pain and suffering component of many different types of injuries.

Find the high verdicts for your particular injury. Send those to the adjuster.

15. Which Cases Has a Jury Awarded More than Your Final Offer?

Insurance adjusters don’t want you to ask is, “Mr. Adjuster, “how many cases have you made an offer to a claimant “like myself, and then a jury has awarded “higher than that offer?”

Rest assured that there’s not an insurance company in Florida that has had a case where they haven’t made an offer and at some point had a personal injury claimant go to trial and get a verdict in judgment for higher than that amount.

But there’s going be a slim chance that the insurance adjuster tells you which cases that happened in. Insurance adjusters are not always right with their offers and their valuations of your claim. That’s why sometimes at a trial they get hit for large amounts.

16. How Many Times Has a Supervisor Settled Your Case for Above Your Final Offer?

A claims adjuster does not want to get asked is, how many times has your supervisor awarded a claimant and paid a claimant for an amount higher than you said your last final offer was?

If you ask them that question, you’re generally going to get the responses, “Speaking with my supervisor is not gonna do any good. “You’re gonna hear the same thing.”

But there are certain times, and it happens often, where the supervisor just has more settlement authority and he may just want to get the file off the desk and closed, and he may award more money. There’s never a guarantee it can happen all the time, but supervisor is a very powerful word.

17. Which Facts are The Worst for Your Case?

Claims adjusters don’t want you to ask is, what are the bad facts for your case? Many facts go into a personal injury case and many things affect the value. Witnesses are one of them.

There’s a chance the insurance company knows about a witness that’s horrible for their defense. For example, a witness may have seen their insured speeding. Or in a slip and fall case perhaps someone who saw a substance on the floor a long time before you slipped and fell. Ask the adjuster what are the worst facts in your case.

You’re gonna get a good idea of how many cards the adjuster is showing you.

18. Does Your Company Usually Increases Its Offer If A Lawsuit is Filed?

A claims adjuster doesn’t like being asked is, does your insurance company typically increase the offer when a lawsuit is filed?

They may say no, they may not be telling you the truth, but the reality is, not in every case but in many cases, when you file a lawsuit, the case gets transferred to a different adjuster who has more authority to settle your case, essentially for more money.

It goes to a higher level adjuster. Sometimes the reserves get increased. That’s the amount of money set aside to pay the claim. It doesn’t always happen.

There are certain insurance companies that stick to their final offer before a lawsuit, but oftentimes insurance companies, particularly if they have to pay an outside attorney and they’re not one of the large auto insurers that has their own attorneys on staff, will increase an offer after you’ve filed the lawsuit.

I had a case against a very large supermarket and they denied liability and forced me to file a lawsuit for my client, who was injured when something fell on her, and as soon as I filed the lawsuit, the insurance adjuster gave me a call and she said, “I don’t know what the other adjuster “was thinking,” which we hear this often.

And she offered $18,000. Now, we continued to litigate that lawsuit and settled for more money, but oftentimes insurance companies will not be fair. You’ll file a lawsuit. The new adjuster will put all the blame on the pre-suit adjuster, saying, “I don’t know what they were thinking.”

Or maybe the defense attorney that’s assigned to the case will put blame on the prior adjuster who was handling the case.

So sometimes a lawsuit can be huge. In one case, we represented a gentleman who slipped and fell. The insurance adjuster denied liability. We filed a lawsuit and later settled for $300,000. So take what insurance adjusters tell you with a grain of salt.

19. What Percent Negligent is Your Insured?

Claims adjusters don’t like being asked is, how much is your insured at fault? Insurance companies have an insured, who is their client.

You want to ask them, “What percentage of negligence “are you placing on your insured?” Sometimes I’ve had cases where the insurance adjuster will tell me. “In this case where our driver hit your insured, “we’re placing 60% blame on our client, and 40% on yours.”

Some of them will tell you. Some of them will say, “I’m not gonna go into that. “That’s privileged information.” But knowing their insurance percentage of fault or at least what they’re saying it is helps you understand why they’re making the offer that they’re making.

In addition, you can see if their estimated percentage of fault is similar to your evaluation. You need to know if their insured is negligent. It’s one of the main factors when evaluating how much your case is worth.

20. How Much Fault Are You Placing on Me?

Insurance adjusters hate when you ask them, how much blame are they assigning to you? Just like number nine, sometimes they will tell you. I have had cases where I’ve filed a lawsuit and the defense attorney says, “Listen. “

We’re placing 25% to 50% blame on your client “for not seeing something that she tripped over “that she should have seen before she tripped.” Sometimes insurance adjusters will tell me, “We’re placing 50% blame on your client “for crossing the road in the middle of daytime” when she wasn’t in a crosswalk.”

I actually had a case like that where my client fractured her lower leg bone and we settled for $70,000, but the insurance adjuster let me get inside her head and she told me, 50% of the blame they were accepting on their client and 50% on my client.

If you had health insurance that paid some of your bills, I have a bonus question. Your health insurance may have a right to get paid from your personal injury settlement.

You’re gonna ask the insurance adjuster, “What percentage of the health insurance lien “are you paying me back for?” See if they’re giving you full reimbursement. The same is true with your medical bills.

Ask them, if your medical bills, out-of-pocket medical bills are 10,000, ask them, “Are you paying me for 100% of my medical bills?”

They may tell you, or they may not.

Did someone cause your injury in an accident in Florida? Or on a cruise?

I want to represent you if you were injured in an accident in Florida, on a cruise ship or boat.

Call Me Now!

Call us now at (888) 594-3577 to find out for FREE if we can represent you.

No Fees or Costs if We Do Not Get You Money

There are No Fees or Costs Unless We Recover Money. Call us 24 hours a day, 7 days a week, 365 days a year. We speak Spanish. We invite you to learn more about us.

Leave a Reply