On May 2, 2013, my client, a police officer, was involved in a car accident while he was working.

He was traveling northbound on SW 87 Avenue while responding to an emergency call; he had his sirens on in his patrol vehicle.

Another driver was traveling westbound on SW 100 Street. GEICO insured the other driver.

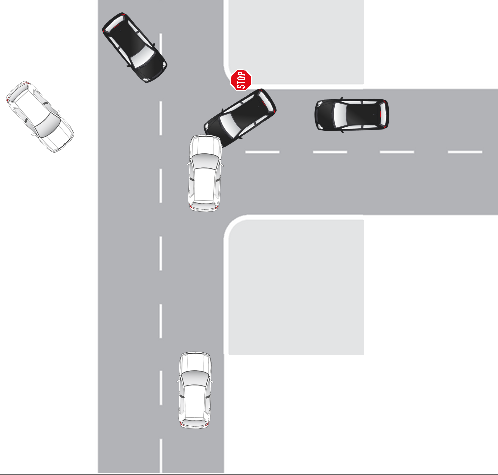

She turned left onto SW 87 Avenue directly impacting my client’s patrol vehicle (picture is below).

The other driver received a ticket for failure to yield the right of way. Liability was clear.

GEICO didn’t blame my client for the accident. There were only two cars involved in this crash.

They were the car that my client was driving and the other car. I drew a picture of the accident scene below.

The black car is the car that received the ticket. My client was driving the white car.

The 2 cars to the far left are where the cars involved in the crash ended up after the impact.

At the scene of the accident, my client was transported to Baptist Hospital, where he was seen in the emergency room. He had trauma to his right hand and cuts to his forehead.

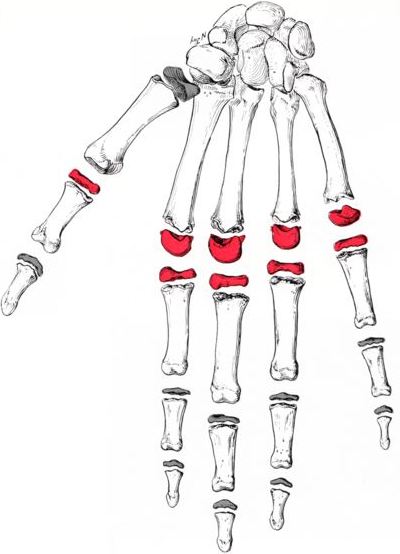

X-rays were performed on his right hand. The emergency room doctors diagnosed him with right fifth metacarpal shaft fracture.

(The fifth metacarpal bone is the metacarpal bone of the little finger or pinky finger). His right forearm was put in a splint.

While in the emergency room he was referred to Dr. Jorge Orbay-Cerrato, an orthopedic surgeon.

On May 14, 2012 Dr. Jorge Orbay-Cerrato performed surgery (an open reduction and internal fixation) of the right fifth metacarpal on him at Kendall Regional Medical Center.

On May 23, 2012 Dr. Jorge Orbay-Cerrato saw him again. His right hand was placed in a splint and he was referred and went to occupational therapy. On June 21, 2012 he had a 2nd surgery where the hardware from his right hand was removed and continued physical therapy until June 28, 2012.

Dr. Jorge Orbay gave my client a zero percent impairment rating. In Florida, if you are injured while in an automobile, in most (but not all) cases in order to get non-economic damages (e.g. for pain, suffering, etc.) a doctor must say that you have a permanent injury.

Find out if you can get non-economic damages (e.g. pain and suffering damages, etc.) in a Florida auto accident case.

This doctor was an authorized doctor under my client’s workers compensation insurance and was paid by my client’s workers compensation insurance.

I know one defense attorney who is of the opinion that a jury is more likely to believe the workers compensation doctor (if he or she was the client’s treating doctor, and particularly when he or she performs surgery) rather than another doctor who examines the patient (injured person) just a couple of times.

One problem with using doctor who is paid by workers compensation insurance is that you are more likely to get no or a low impairment rating because some workers compensation doctors will do everything to minimize your impairment.

Many authorized workers compensation doctors want future business from a workers compensation insurer and may give lower impairment ratings because of this.

If these doctors are not very conservative with their impairment ratings, the workers compensation insurer will find another doctor to send other workers to.

On 4/24/2013, he treated with Dr. Robert Moya where he described his pain level as 6 out of 10. Dr. Robert Moya is one of the orthopedic doctors that I recommend for people who want a doctor to treat them for a hand injury if they were in an accident where someone else is at fault.

Dr. Robert Moya gave him a permanent impairment rating of 3% and related this injury to this accident. During the examination Dr. Robert Moya noticed and indicated there is deformity visualized on the 5th carpal following the fracture and subsequent surgery and the 5th metacarpal is shorter.

Dr. Robert Moya performed a range of motion examination on my client. He noticed the range of motion of the fingers at the metacarpophalangeal joints is mildly restricted with pain at the 5th metacarpophalangeal joint metacarpal(s).

As a result of this accident, for some time my client could not use a firearm, which is a requirement of his occupation. He missed approximately two months of work. He was not paid for 33 1/3% of his wages, which amounts to $3,132.64.

Lost Wages not paid by Worker’s compensation (33 1/3% of wages): $3,132.64

Total worker’s comp lien: $33,300.19

Total health insurance lien: $830.00

Dr.’s bills not paid by health insurance or worker’s comp: $936.27

Total damages (not including pain and suffering): $38,199.10

Total medical services billed: $46,469.40

GEICO’s opening offer was approximately $81,000.00. This case settled for $125,000. Miami-Dade County claimed a workers compensation lien of $33,300.

Through negotiation, I was able to get Miami-Dade county to accept $12,500. My client owned a car in Florida at the time of the crash. So he was covered under PIP on his personal auto insurance.

After we paid off the workers compensation lien (which was more than $9,750), I was able to get my client’s auto insurer, State Farm, to pay us $9,750, which was the amount of the unused Personal Injury Protection (PIP) coverage.

So my client basically received $90,000 in pain and suffering for his broken wrist.

When I spoke with a State Farm claim’s representative on the phone, they stated that they weren’t aware of any law that said that State Farm had to reimburse my client.

I am happy that State Farm quickly reimbursed my client. However, after I presented this claim to State Farm, I was a bothered that they either did not know this law or acted like they did not.

I can see how some people or even attorney would have believed State Farm and not tried to get State Farm to repay the client (for the amount of money that was paid by the client from the client’s bodily injury settlement to settle the workers compensation lien.

Not knowing this law would have resulted in recovering $9,750 less. At the end of the case my client told me that he would have accepted GEICO’s opening offer of $81,000.

He told me that he would not have known that he could or should have negotiated with GEICO.

This assumes that GEICO would have made an opening offer to my client of $81,000. So based on what my client told me, I was able to get my client a total (gross) settlement of about $53,000 than the amount that my client said that he would have accepted had he not hired me.

Now, I want to make it clear that prospective clients may not obtain the same or similar results. Another huge benefit that my client received by hiring me is that he did not have to spend time requesting medical bills, records and other documents. It is important to understand how to get your medical bills paid after a car accident in Florida.

So we did a presuit mediation (which I always encourage) with GEICO and settled for $125,000. GEICO paid for the mediator’s fees, which I appreciate.

I wish GEICO would have offered the $125,000 before mediation. It would have saved my client and me time.

However, I have to give GEICO some credit for being reasonable with this case. They suggested pre-suit mediation. We settled before suing the other driver and car owner.

While filing a lawsuit is sometimes necessary, this was a case where it was not.

Prospective clients often ask me whether they need an attorney. My answer is usually yes. To show you how much work goes into a case:

- I sent about 190 emails/faxes in this case, many of which were to my client, GEICO, medical providers, State Farm (PIP) and the workers compensation self-insured (Miami-Dade County).

- I received about 230 emails/faxes, some of which were from my client, my assistant, medical providers, GEICO, State Farm and the workers compensation insurer.

- My assistant and I spent a great deal of time talking to and negotiating with different insurance companies as well as dealing with medical providers.

Geico is one of the largest Florida private passenger auto liability insurers. The other ones that make up the Top 15 in terms of market share are:

- State Farm

- Progressive

- Allstate

- United States Automobile Association (USAA)

- Travelers Home and Marine Insurance Company

- Safeco Insurance Company of Illinois (A Liberty Mutual Company)

- 21st Century Centennial Insurance Company (part of the Farmers Insurance Group of Companies)

- Infinity Insurance Company

The above is in addition to the fact that:

- I have the proper forms/documents to send out and I know when to send them out.

- I understand how to review medical records and bills.

- I understand the interplay between insurances (PIP, BI liability, workers compensation insurance and health insurance).

- I understand how to fight to get liens reduced.

- I have a strong knowledge of Florida personal injury law.

My client gave me this review:

“Justin cared about me and went over and beyond to make sure I was taken care of. I’m 100% satisfied with everything. Justin will be my first call God forbid something else was to happen to me again. What attorney do you know who will drive to you on a weekend? Justin answered all of my questions and phone calls 24/7.

I wouldn’t choose any other attorney, hands down. Justin, Thank you for everything you have done for me. I truly appreciate all of your had work.”

Prospective clients may not obtain the same or similar results.

I am very appreciative that my client trusted me with his case. I love being able to help people…hence our law firm name JZ helps.

Were you injured in an accident?

I have settled many Florida injury cases, including car accidents, slip and falls, and cruise ships accidents. I want to represent you if you were injured in an accident in Florida, on a cruise ship or boat. Call me now at (888) 594-3577 to Get a Free Consultation.

There are No Fees or Costs Unless We Recover Money. Call us 24 hours a day, 7 days a week, 365 days a year. We speak Spanish. We invite you to learn more about us.

me and my sons age 13 and 15 were in a car accident on october 16th 2013 it was not my fault the other car t boned us and the local cop saw the accident and we both have gieco insurance. she hit my sub on the passenger where my 13 year old was sitting he broke his hand and i suffered back neck shoulder and head injuries with head aches that i still have today

my head hit the window my 15 yr suffered back neck head his head hit the window as well he was sited behind me on the driver side injury to his rotator cuff we went to ER and from there went to chiropractor the boys was out of school for 4 days i missed 2wks of work my job is demanding and i have to be focused and able to perform so until i could get better i had 2 wks off my hours are 9-6 no exceptions and my mngr has allowed me to leave early 3 days a wk so me and the kids can get our treatment at the chiropractor

can i get reimbursed for hours lost while working due to the fact that i have already sent back my wage loss forms I’m still going to chiropractor my baby boy 13 he had to go ortho carolina he jus got his cast off on the the 15 of november he still has hand therapy but my 15 yr was released from the chiropractor today the insurance company is looking to settle with him next wk what should the settlement amount be based on what i told you and based on myself what should the settlement amount be for me and what should my 13 year old settlement be worth due to his broken hand and injury to his rotator cuff????

he plays football he couldn’t play the remaining of the season due to the accident he can’t go out for basketball ortho dr orders she says he needs to wait til jan 2014 before doing any serious sports he starts training for the swimming team in dec I’m concerned about his rotator cuff for this sport i can see it being good and bad i wouldn’t want his arm to give out or stiffing up in the swimming then i can see it being good exercise i dnt have legal representation should i get legal advise is it to late i wanted to knw too by the lady at fault and me having the same insurance company would that have something to do with us not getting the moneys we deserve?

or be a conflict of interest of some sort i was join to see what that offered first then go from there i jus need a ball park figure as far as what they will settle me and my sons out for and try to nogotiate then if they dent want to do that get legal advise what should i do and can you give me some pointers and possibly settlements that is feasible for me and my family

Anonymous 1,

Thank you very much for your comment. I assume that this accident happened in Florida because I am only licensed to practice law in Florida. I will not become your attorney by responding. I am sorry to hear that you were in a car accident with your children.

I assume that you mean she (the driver of the other vehicle) hit your “side” on the passenger when you said that she hit your “sub” on the passenger.

In Florida, you may be able to get your reimbursed for hours lost from being unable to work due to a car accident. In Florida, your own car insurance may be responsible for 60% of the lost wages. If you can prove that another driver was at fault or someone else, then you may be able to get the other 40% reimbursed. In Florida, if you exhaust (use of) your own no-fault insurance, then the other driver may be 100% at fault if you can prove that he or she caused the accident.

Unfortunately, at this time, I cannot tell you what the settlement amount for your 15 year son should be because there are too many factors (things) that I don’t know, including but not limited to:

1) Did anyone receive a ticket, if so who?

2) Who was listed as driver #1 on the police (crash) report?

3) What did the other driver say happened?

4) Were there any traffic control devices (stop signs, traffic lights, yield sign, etc.) and if so, where were these signs located and did anyone violate one?

5) Where was the point of impact (damage) on the passenger side of your car?

6) How much damage there was to the passenger side of your car? Did you take pictures of the damage to your vehicle? How much damage was there to the other car?

7) Did the airbags of either car deploy? If so, which airbags deployed (came out)? Did the airbags of both cars deploy?

8) Was your son wearing a seatbelt at the time of the crash?

9) Do you have the 911 audiotape?

10) Did the police officer actually witness the accident? If so, who did he or she say was at fault and why?

11) Was your car towed from the accident scene? Was the other car towed?

12) Was an ambulance called to the accident scene? If so, did it take your 15 year old to hospital? Did you son complain of back, neck and head pain at the time of the accident? Did he tell this to the paramedics?

13) Do you live in Florida? If so, was your car insured at the time of the accident?

14) Has your 15-year son been treated for back, neck or head pain before this car accident? If so, when was the last time that he received treatment and how long did his treatment last?

15) Did your son have an MRI or CT scan? If yes, which body parts? Was your son diagnosed with a herniated disc or bulging disc?

16) Did your son tear his rotator cuff? If so, what type of tear was it (full thickness, partial thickness, etc.)?

17) What is the chiropractor’s reputation? Is he Plaintiff (injured person bringing the claim) oriented or is he defense oriented?

18) Does he have any out of pocket bills for the ER, chiro visit or prescriptions?

19) Did he have health insurance at the time of the accident? If so, they may have a lien (be entitled to be repaid and if you do not repay them they may be able to deny future medical treatment).

…And the list of questions that I have goes on and on.

Because you did not mention it, I assume that you were not speeding.

The same above questions apply to your #13 year old though it is generally easier to prove that a broken wrist is related to a car accident as compared to back or neck pain, which be more subjective (based on his complaints). I also cannot tell you what the 13 year olds case is worth because there are too many unanswered questions.

What type of hand fracture (simple, compound, comminuted, etc.) did he have?

It is great to hear that your 13 year old is so athletic.

You should definitely IMMEDIATELY get legal advice. There is a time limit to file a lawsuit and if you miss it your claim will be unable to file a lawsuit.

If this happened in Florida, or if you or any of your children live in Florida please call me at (888) 594-3577 to get a free no obligation consultation. There are no fees or costs unless I recover money for you. Every personal injury attorney that I know gives a free consultation. I am available 24 hours a day, seven days a week.

The fact that your car insurance company (GEICO) is the same as the other drivers should not make a difference in your claim.

Do you know how to add language to the settlement release, if appropriate? This can be very important. I hope that my questions at the least gave you some important things to thing about.

This is not legal advice.